Headline: Gold Suffers Sharp Pullback as US-China Tariff Rollback Sparks Risk-On Rally

Over the weekend, US and Chinese officials met in Switzerland, where both sides agreed to a significant de-escalation of trade tensions. The United States will reduce tariffs on Chinese imports from 145% to 30%, while China plans to lower levies on US goods from 125% to just 10%—both for a 90-day trial period. This mutual compromise ignited optimism across equity markets and undermined demand for traditional safety plays like gold.

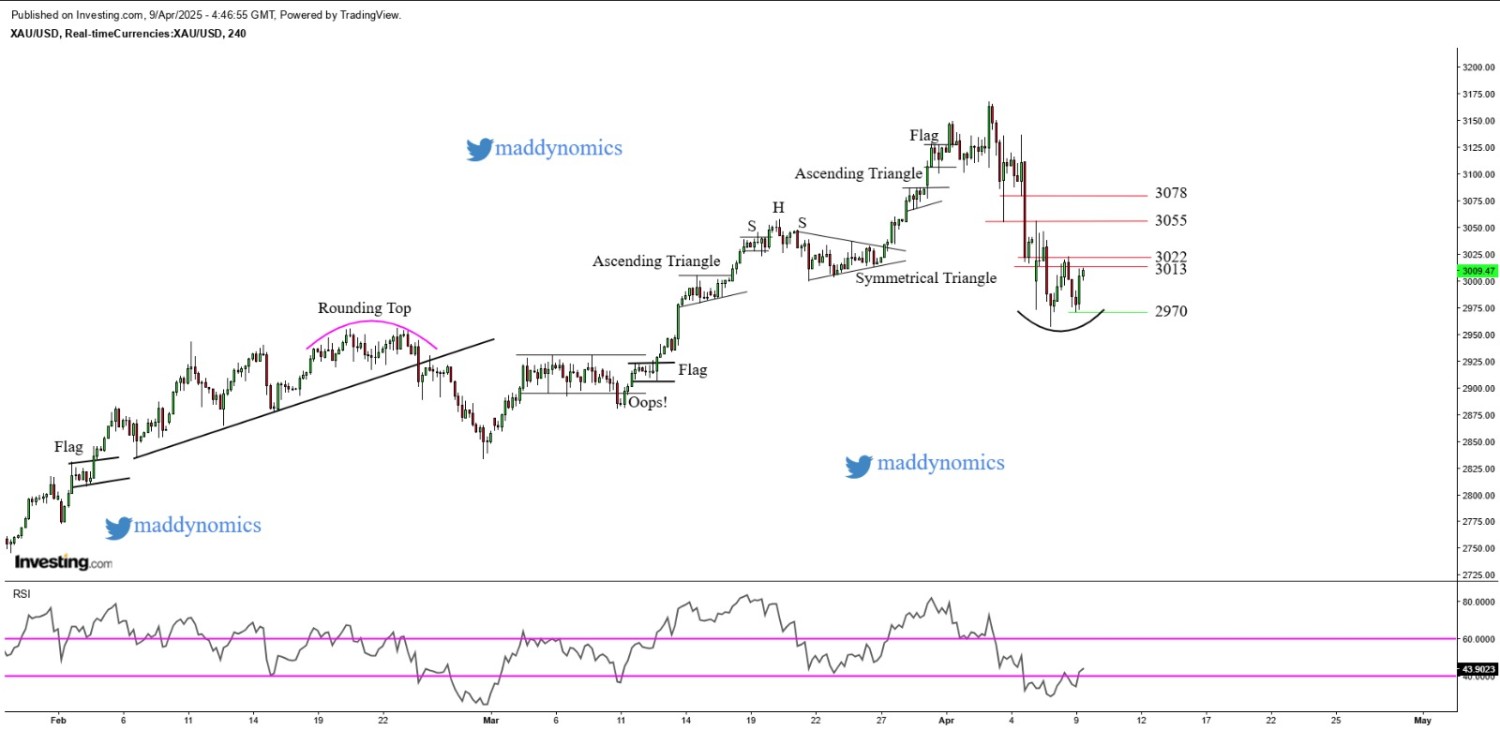

Technical Breakdown: Double Top Confirms Reversal

The daily gold chart paints a technically bearish picture, reinforcing the sentiment shift. A well-formed Double Top pattern near the $3,439 resistance level has now confirmed a reversal after price failed to break above this key zone twice. The breakdown from the neckline has triggered a swift selloff, with gold now hovering near $3,227.

Support levels to watch on the downside include:

-

$3,165.72 – immediate support

-

$3,049.41 – intermediate level that may offer a bounce

-

$2,842.82 – strong longer-term support

Recent News

Gold Prices Eye Fresh All-Time Highs Aft...

February 24, 2025

Market Insights

Gold regains momentum on rising safe-hav...

April 09, 2025

Market Insights

Gold coils in a Falling Wedge pattern ah...

August 01, 2025

Market Insights

Dow Jones Futures Show Bearish Breakdown...

April 16, 2025

Market Insights

Dow Jones at Critical Support Flag Forma...

February 28, 2025

Market Insights

Gold consolidates to build up momentum a...

April 30, 2025

Market Insights