Headline: Gold Suffers Sharp Pullback as US-China Tariff Rollback Sparks Risk-On Rally

Over the weekend, US and Chinese officials met in Switzerland, where both sides agreed to a significant de-escalation of trade tensions. The United States will reduce tariffs on Chinese imports from 145% to 30%, while China plans to lower levies on US goods from 125% to just 10%—both for a 90-day trial period. This mutual compromise ignited optimism across equity markets and undermined demand for traditional safety plays like gold.

Technical Breakdown: Double Top Confirms Reversal

The daily gold chart paints a technically bearish picture, reinforcing the sentiment shift. A well-formed Double Top pattern near the $3,439 resistance level has now confirmed a reversal after price failed to break above this key zone twice. The breakdown from the neckline has triggered a swift selloff, with gold now hovering near $3,227.

Support levels to watch on the downside include:

-

$3,165.72 – immediate support

-

$3,049.41 – intermediate level that may offer a bounce

-

$2,842.82 – strong longer-term support

Recent News

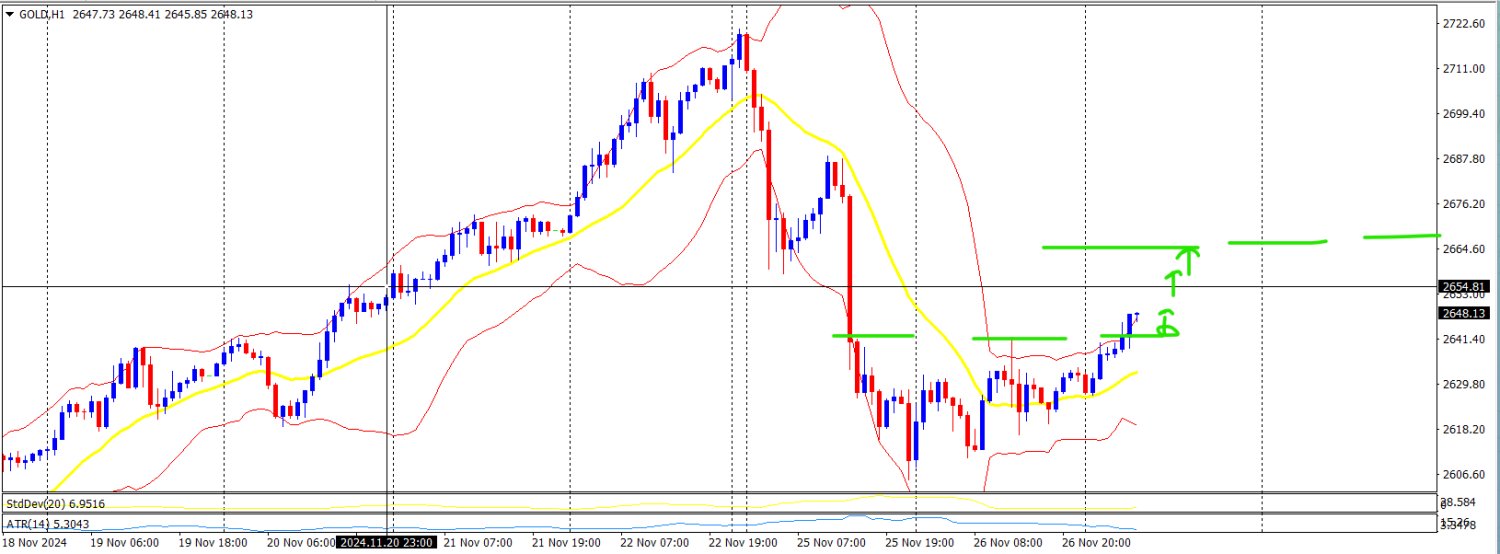

Gold price sticks to modest intraday gai...

November 27, 2024

Market Insights

Dollar Index (DXY) Holds Above Key Pivot...

February 10, 2025

Market Insights

US Tech 100 Breaks Out of Downward Chann...

March 24, 2025

Market Insights

NASDAQ consolidation on daily lower leve...

October 01, 2025

Market Insights

Gold holds below $3,400 as traders stay...

June 18, 2025

Market Insights

DOW JONES bounce back after President Do...

October 13, 2025

Market Insights