Gold regains momentum on rising safe-haven demand

Up by 1%, Gold jumped all the way to $3032-$3035 region, clearing Tuesday's high of $3022 with ease. The precious metal has witnessed heightened volatility majorly fueled by intensifying trade conflicts between USA and its trading partners. Within a span of one week, President Trump amplified tariffs on Chinese imports from 34% to 104% in response to Beijing’s retaliatory measures, accusing China of devaluing the yuan to soften the impact. In return, China refused to bow down and vowed to fight against America's aggression "to the end.” Despite some setbacks last week, gold remains on track amidst ongoing global trade war and concerns over recession that might follow.

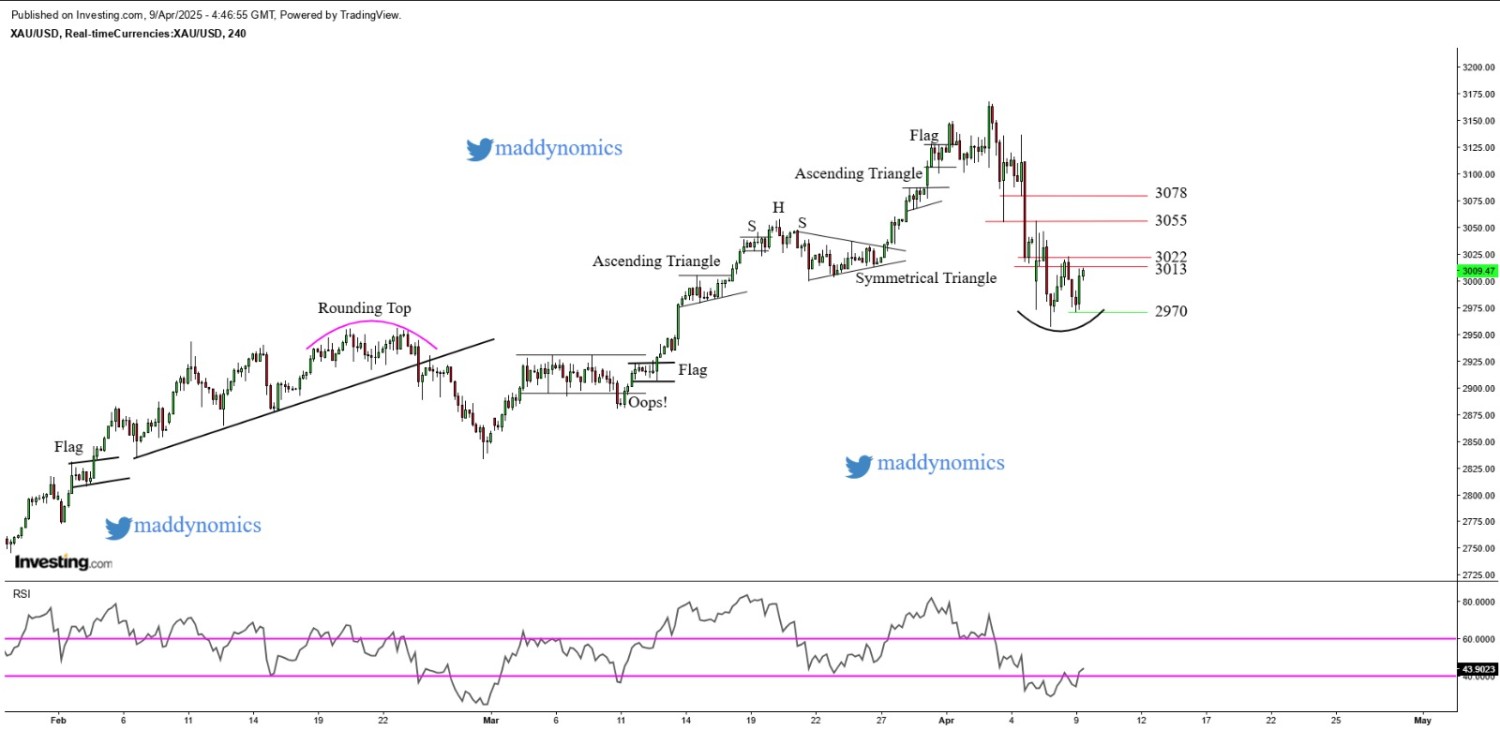

XAU/USD TECHNICAL OUTLOOK

Gold is displaying mixed signals across multiple timeframes. A Gravestone Doji on the daily chart suggests buyers might lose strength at higher levels while the 4-hour chart forms a Double Bottom structure, indicating bullish reversal. On the 1-hour chart, a Bull Flag indicates continuation of the uptrend.

Intraday Strategy: Stay bullish above $2,995. Intraday strategy favours buying on dips and breakouts.

Intraday Trend: Neutral bias unless price breaks key levels.

Weekly Trend: Neutral

Key Resistance Levels: 3045, 3066, 3075

Key Support Levels: 3022, 3018, 3012

Recent News

Gold price snaps five day winning streak...

November 25, 2024

Market Insights

NASDAQ making a bullish flag, must watch...

October 13, 2025

Market Insights

US Tech 100 Breaks into a Bullish Flag F...

June 03, 2025

Market Insights

DOW JONES making a Wedge pattern on dail...

March 19, 2025

Market Insights

Federal Open Market Committee (FOMC):-

November 07, 2024

Market Schedule

US100 forms bearish pennant near support...

August 04, 2025

Market Insights