Gold price stalls intraday recovery from $2,600 amid rising US bond yields

GOLD ANALYSIS & NEWS

Gold price stalls intraday recovery from $2,600 amid rising US bond yields

~Gold dropped yesterday almost $100. It dropped from $2721 to $2605.

~Gold dropped in US session after making a high of $2689.

~Gold made a low of $2605 in today's early Asian session.

GOLD has plunged 📉 over 4% (2721 to 2605), BUT WHY❓

- Reports indicate that Israel was on the brink of reaching a ceasefire agreement with the militant group Hezbollah in Lebanon.

- There is optimism about Scott Bessent's nomination as US Treasury Secretary, with expectations that will implement a more gradual, phased approach to tariffs.

- US President-elect Donald Trump threatened to impose a 25% tariff on all products coming into the US from Mexico and Canada and an additional 10% tariff on all Chinese imports.

FURTHER CUES🇺🇸

Market players now look to the FOMC minutes for cues about the future rate-cut path, which will drive the USD demand and provide a fresh impetus to the commodity.

WHAT'S EXPECTED IN GOLD TODAY?

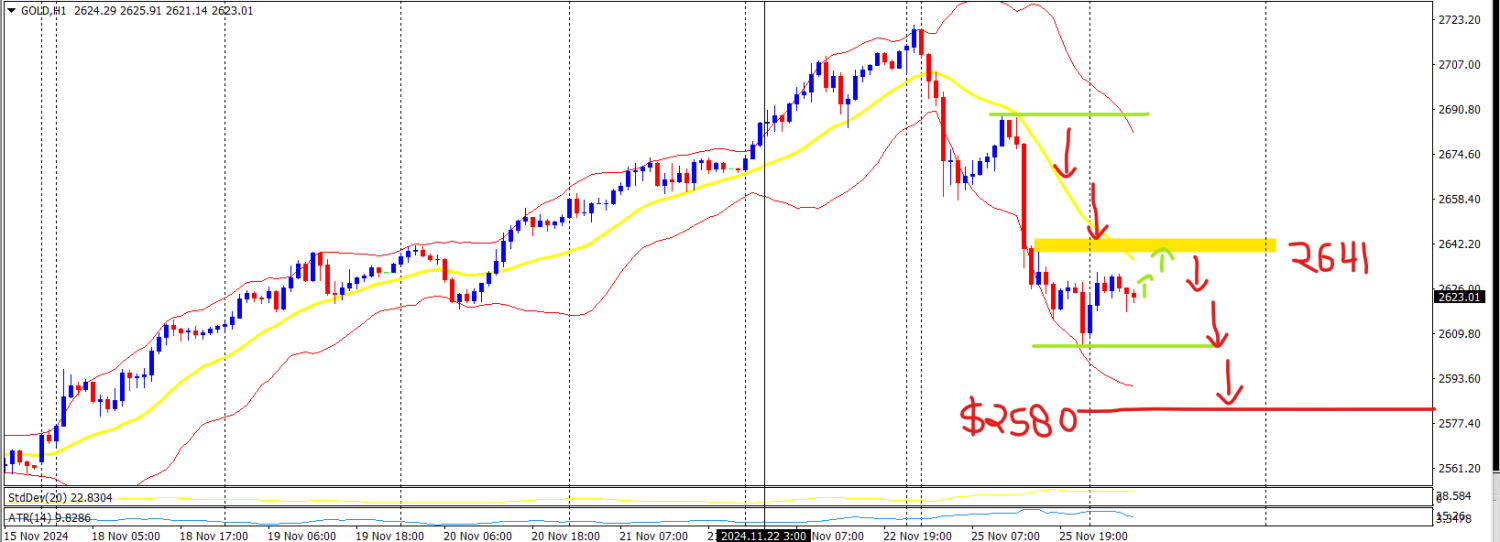

1. Gold is still in Bearish zone and it may drop further.

2. Gold is expected to drop further more, If Gold manages to break today's low of $2605. Then it can potentially test $2580 levels.

3. If Gold reverse and take a correction, It has to pass resistance at $2641 level. Then it can test $2667 levels.

4. SELL on RISE strategy will be good for GOLD today, $2635-40 will be a key level to short again.

Recent News

AUDUSD trading at oversold range as per...

October 28, 2024

Market Insights

US Tech 100 (USTECH100) Forms Bullish We...

July 09, 2025

Market Insights

DOW JONES bounce back after President Do...

October 13, 2025

Market Insights

NASDAQ 100 Faces Continued Selling Press...

August 19, 2025

Market Insights

EUR/USD Holds at Key Neckline Support Ah...

May 02, 2025

Market Insights

NASDAQ gave Channel breakout but now mak...

March 19, 2025

Market Insights