Gold price consolidates within a tight range on Monday, foreshadowing a massive breakout.

Gold prices slipped below $2920 in Monday's session, largely remaining subdued within a range of 20 points. Traders closely monitor Federal Reserve's policy stance as the U.S. monthly employment numbers released on Friday suggested fewer jobs were added the previous month, indicating a slowdown in U.S. labour market. Furthermore, monthly unemployment rate ticked up to 4.1% from 4.0% reaffirming bets for further policy easing by Fed. Investors remain worried about Trump's inflationary tariff measures that could hurt the U.S. economy. The Yellow Metal continues to stay rangebound, mirroring the trajectory it followed the previous week.

GOLD TECHNICAL ANALYSIS

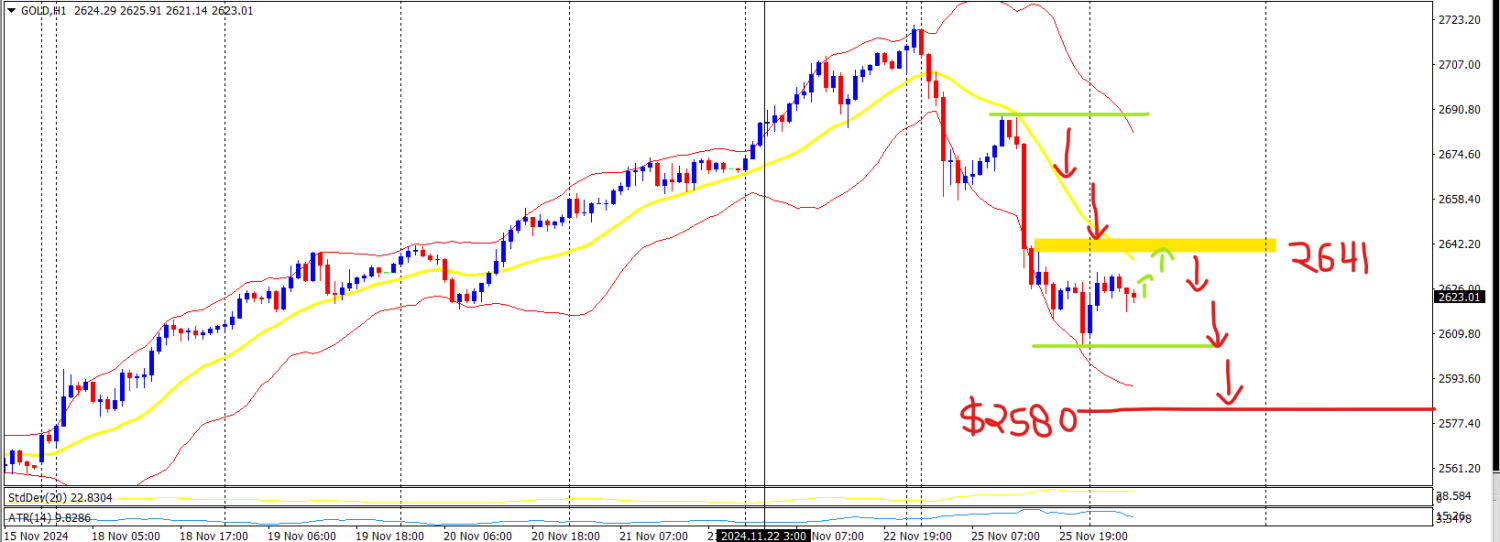

Gold Structure: Bullish Candle on Weekly, 4 Days of Sideways Action in Daily, Bear Flag on 1hr.

Intraday Strategy/ Intraday Trend: Buy on Supports, Sell on Resistance/ Neutral

Weekly Trend: Neutral to Bullish

Major Resistance: 2918, 2923, 2931

Major Support: 2908, 2904, 2898

Recent News

Gold’s Outlook Amid High Yields and a St...

November 14, 2024

Live Charts

Gold price stalls intraday recovery from...

November 26, 2024

Market Insights

USD/JPY shows signs of recovery, stickin...

March 12, 2025

Market Insights

Dow Jones Breaks Out of Bullish Flag For...

May 20, 2025

Market Insights

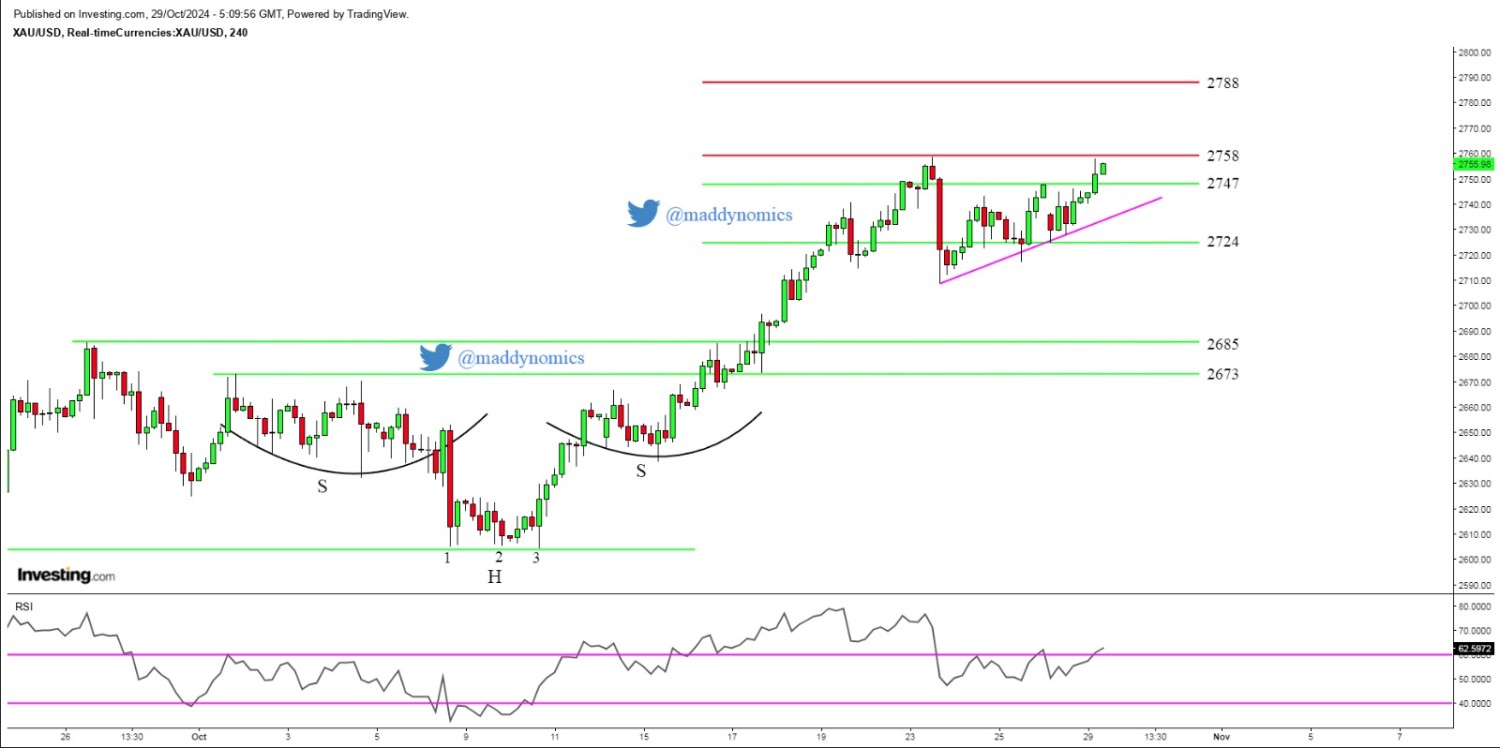

Gold trading near ATH, Bulls are waiting...

October 29, 2024

Market Insights

Gold Price Analysis: Bearish Reversal or...

February 21, 2025

Market Insights