Gold holds firm near two-week high amid renewed safe-haven demand

Gold prices regain bullish momentum during the Asian session on Friday, bouncing back from Thursday’s mild correction and holding firm above the $3300 level. The renewed uptick comes as a combination of macroeconomic and geopolitical factors continues to underpin the safe-haven appeal of the precious metal. Mounting concerns over the deteriorating US fiscal outlook, including rising debt levels and political gridlock on budgetary decisions, are fueling investor anxiety. Simultaneously, renewed tensions between the US and China, particularly over trade, are reviving fears of a broader geopolitical rift.

Persistent conflicts in Eastern Europe and the Middle East also contribute to market unease, further boosting demand for gold as a hedge against uncertainty.

Adding to the bullish tone, the US dollar is facing renewed selling pressure amid growing market consensus that the Federal Reserve could begin cutting interest rates in the second half of 2025.

XAU/USD TECHNICAL OVERVIEW

Technical Structure: Gold continues to exhibit a bullish technical structure across multiple timeframes, reinforcing a positive outlook. The daily chart is forming a bullish flag pattern, typically a continuation signal. On 4-hour chart, Gold is hovering above the 20-SMA which is acting as a dynamic support. A clear breakout from recent consolidation on 1-hour indicates renewed buying interest and signals possible intraday extension.

Intraday Trend/ Intraday Strategy: The intraday bias remains bullish and favours the approach of Buying on Dips towards support levels and Buying on confirmed breakouts.

Weekly Trend: Bullish

Major Resistance: 3345, 3370, 3380

Major Support: 3297, 3287, 3278

Recent News

NASDAQ is sustaining on daily Resistance...

December 24, 2024

Market Insights

Dow Jones at a Crossroads Resistance Hol...

April 24, 2025

Market Insights

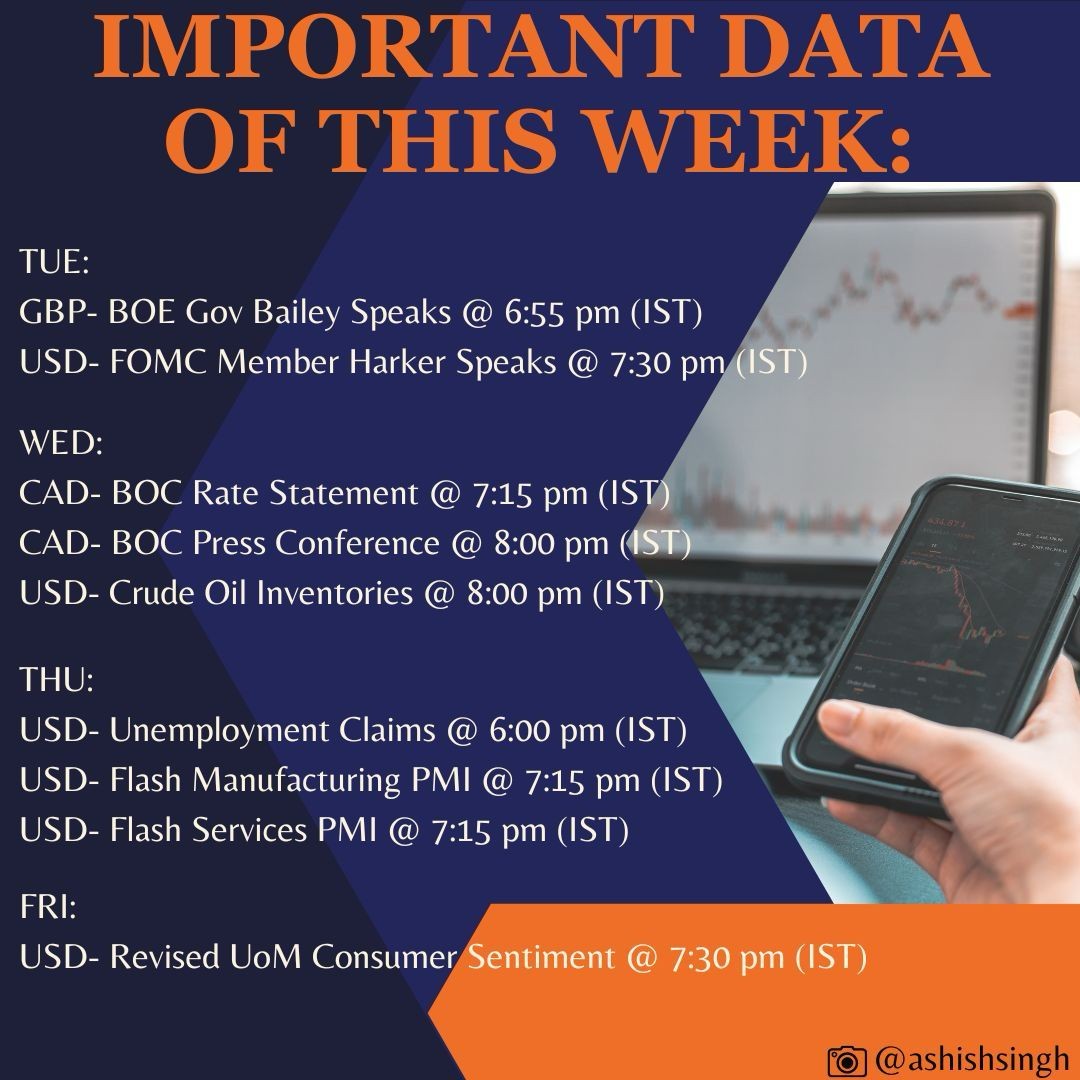

IMPORTANT DATA AND EVENT FOR THE WEEK

October 22, 2024

Market Insights

Dow Jones US30 Forms a Potential Triangl...

March 06, 2025

Market Insights

Gold Holds Near $2,685 Amid Fed Rate Cut...

November 08, 2024

Market Insights

DAX Poised to Test Key Support Level

December 20, 2024

Market Insights