Gold holds below record highs amid risk-on mood, though downside remains limited.

Gold prices faced intraday selling after hitting a fresh all-time high of $3357 during the Asian session as improving risk sentiment weighed on safe-haven demand. A modest rebound in the US Dollar from multi-year lows added further pressure. However, a significant pullback appears unlikely amid ongoing uncertainty surrounding Trump’s tariff plans, rising US-China tensions and global recession risks. Fed Chair Powell's recent remarks also weighed on the market, as he warned that trade policies could increase inflation and slow growth, which continues to drive demand for safe-haven assets like gold.

XAU/USD TECHNICAL OVERVIEW

Technical Structure: The appearance of a Bullish Marubozu candle on the daily chart indicates strong upward momentum, reinforcing a bullish outlook for gold. However, a Shooting Star pattern on 4-hour chart suggests short-term price exhaustion with a possibility of a slight pullback before the trend resumes.1-hour chart showcases a Bullish Flag pattern, signaling consolidation within an uptrend, indicating that a breakout to the upside is likely.

Intraday Strategy/Trend: Intraday Trend appears Bullish and favours Buy on Supports & Buy on Breakouts Strategy. Enter long positions at key support levels including 3314, 3300 and 3290 where price may find strong buying interest. Look for opportunities to buy on breakouts above resistance levels such as 3330, 3348 and 3357.

Weekly Trend: Ultra Bullish

Recent News

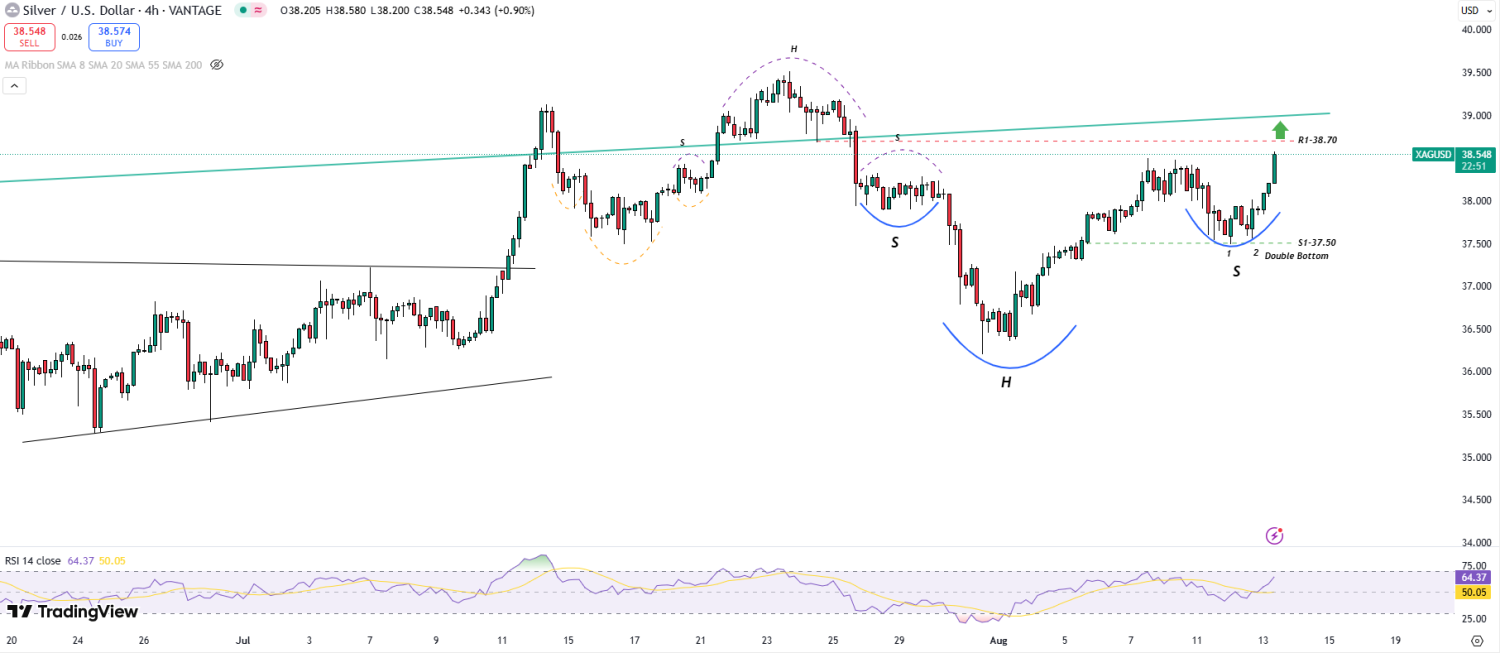

Silver forms massive Inverted Head & Sho...

August 13, 2025

Market Insights

DJ30 Consolidates Near Resistance as Bul...

August 07, 2025

Market Insights

Gold blazes past one week high ahead of...

May 06, 2025

Market Insights

US Tech 100 Eyes Recovery Support Holdin...

June 18, 2025

Market Insights

Will the US CPI inflation data determine...

March 12, 2025

Market Insights

GBPUSD making a wedge pattern

December 10, 2024

Market Insights