Gold climbs to $3000 but scope for gains remains vague

Gold price extended its rebound beyond the $3000 psychological mark on Tuesday's trading session driven by persistent trade war concerns. Beijing, on Friday, struck back at the U.S. with retaliatory tariffs of 34% on all U.S. goods, mirroring the latest extensive duties levied by President Donald Trump. Intensifying the trade war, Trump reiterated his threat to impose an additional 50% tariff on Chinese goods if Beijing doesn't roll back its 34% counter-tariffs, a move he demands by midday tomorrow.

European and Asian markets lose ground as Trump's aggressive tariffs continue to send shockwaves though the global supply chains and weigh on investor sentiment. Gold's volatility has increased as investors balance safe-haven demand with selling the precious metal to raise cash and offset losses amid growing market stress.

Market participants await FOMC meeting minutes to gain insights into Fed's monetary policy decision as current economic downturn raises odds of a rate-cutting cycle.

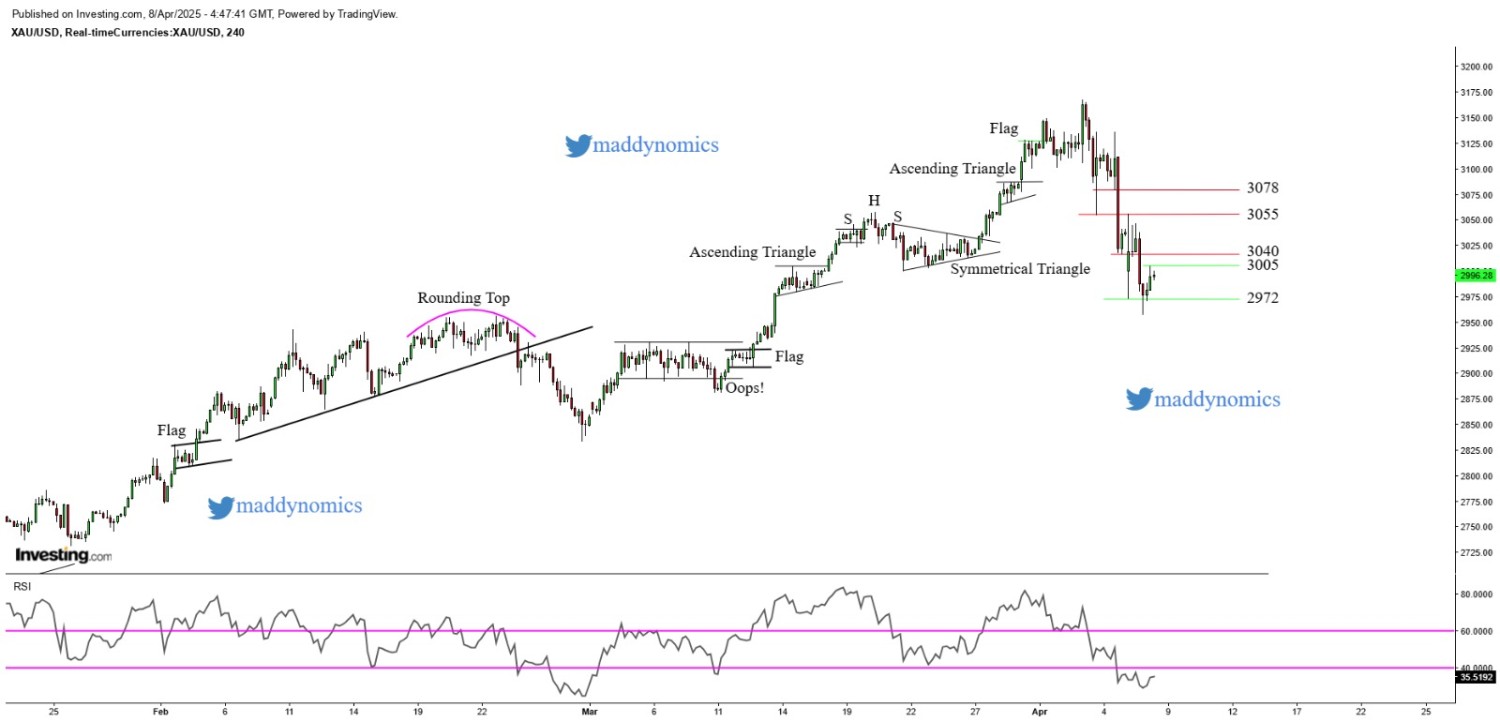

XAU/USD TECHNICAL OUTLOOK

Gold is displaying bearish momentum in the short term with a Three Black Crows candlestick pattern formed on the daily chart. The price is also trading below the 20-day SMA signaling a market downturn. On the 1-hour chart, gold remains in a consolidation phase awaiting a clear breakout on the either side.

Intraday Strategy:

Intraday sentiment remains bearish and favours 'selling on break of key support levels' and 'selling near resistance' strategy.

Weekly Trend: Neutral

Key Levels:

-

Resistance: 3010, 3014, 3025

-

Support: 2990, 2978, 2970

A break below 2990 could open the door for further downside toward 2970. However, sustained strength above 3025 may shift momentum back in favour of buyers.

Recent News

Gold prices hover at record highs upon F...

March 20, 2025

Market Insights

Gold eyes $4,000 as negative bias persis...

October 09, 2025

Market Insights

DAX tumble due to US Election

November 06, 2024

Market Insights

US30 Forms Bearish Pennant Below Key Sup...

July 16, 2025

Market Insights

DAX sustaining on daily higher levels.

November 18, 2024

Market Insights

US Tech 100 at a Critical Support Zone W...

May 22, 2025

Market Insights