GBP/JPY soars as Bank of Japan holds rate steady

GBP/JPY edged higher to 194.70 mark after Bank of Japan made no shift in its monetary policy, dashing hopes for a rate hike. The Yen oscillated between gains and losses shortly after the decision came out however later traded precisely lower. Traders now have their eyes on Bank of England's policy meeting which will be conducted on Thursday. UK's central bank is expected to maintain the key interest rate at 4.50% which could keep the pair afloat.

From technical perspective, GBP/JPY pair extends its winning streak beyond the 200 SMA on its daily chart pumping up hopes for further gains. However a shooting star candlestick formed on the daily timeframe signals some caution ahead as it's a sign of bearish reversal.

GBP/JPY TECHNICAL ANALYSIS

Technical Structure: Shooting star candlestick on daily, close below 200 SMA on daily, Consolidation on 4H.

Primary Trend : Uptrend

Intraday Trend/Intraday Strategy : Mildly Bullish to Neutral/ Buy on Support, Sell on Resistance

Major Support: 193.50, 192.50, 191.35

Major Resistance : 194.75, 195.80, 196.60

Recent News

NASDAQ US TECH 100 IF BREAKS BULLISH FLA...

April 01, 2025

Market Insights

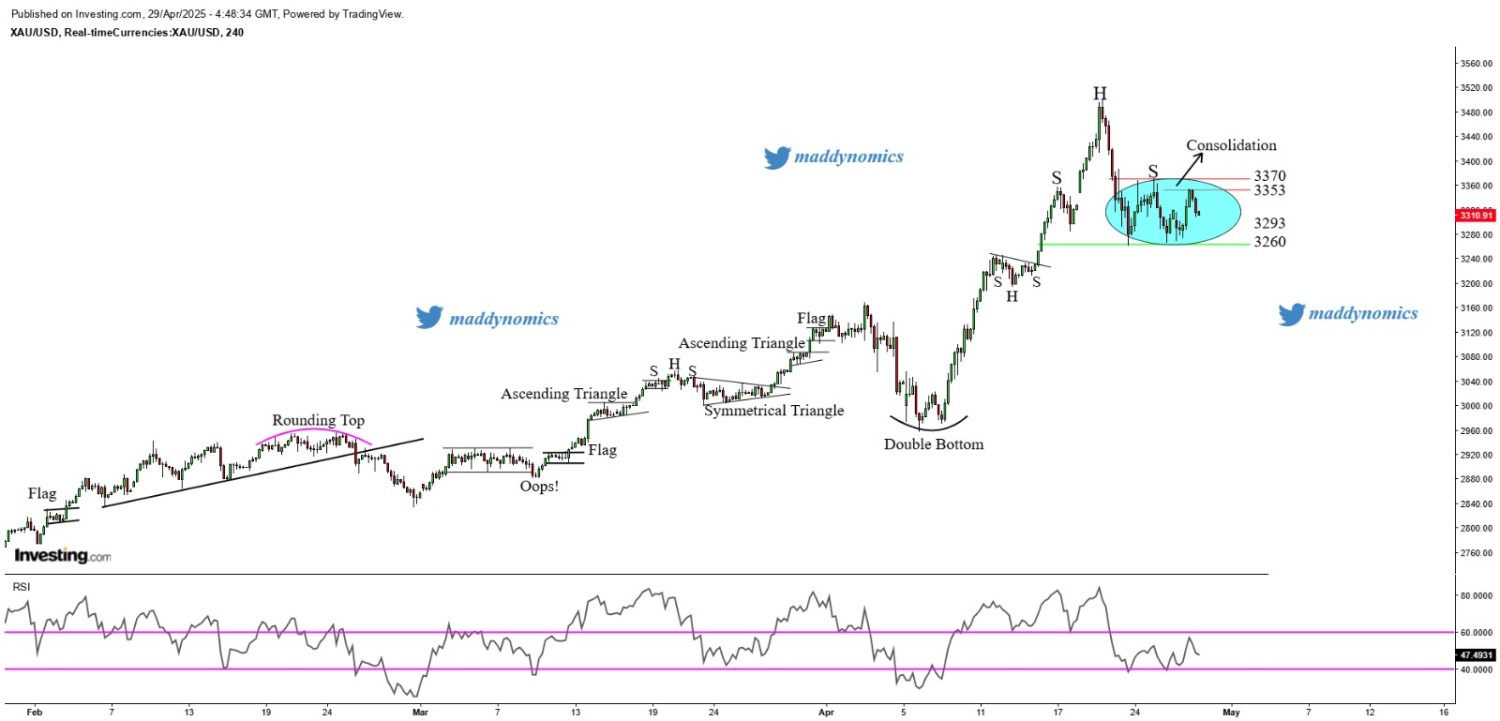

Gold consolidates but remains vulnerable...

April 29, 2025

Market Insights

BTC on the Brink: Consolidation at $94K-...

February 22, 2025

Market Insights

DOW JONES making a bullish flag near to...

July 02, 2025

Market Insights

Oil Prices Climb for Second Day Amid Fre...

February 25, 2025

Market Insights

NASDAQ making a Symmetrical in 1HR

February 12, 2025

Market Insights