V-shaped recovery in Gold! The yellow metal rallies back to $2920.

It seems like bulls are not yet ready to give up as Gold prices strongly reversed after hitting a low of 2900 in Tuesday's session. Uncertainty looming around a peace deal between Russia and Ukraine and an ongoing trade war boost the demand for this safe haven asset. A strong bullish candle on the daily chart of Gold suggests further positive momentum along with an inverted head and shoulder pattern formed on 4H timeframe. Weekly trend is bullish to neutral so buying on support and selling on resistance strategy seems fit. Crucial support lies at 2901, 2895 & 2887 while important resistance levels to watch out for are 2915, 2921 & 2928.

Recent News

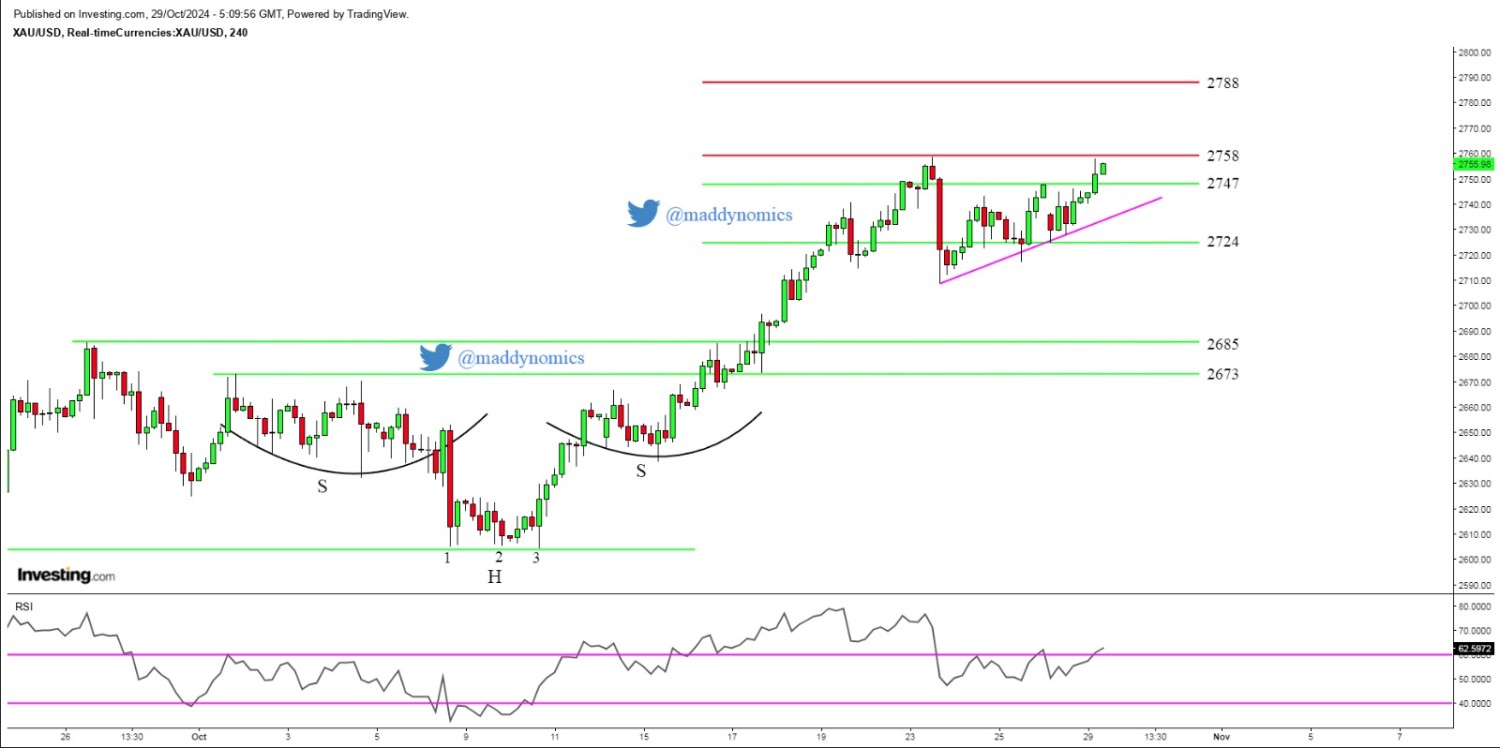

Gold trading near ATH, Bulls are waiting...

October 29, 2024

Market Insights

US30 Forms Bullish Flag Near 44,200 – Ey...

August 05, 2025

Market Insights

DOW JONES bounces back from daily suppor...

February 27, 2025

Market Insights

US Tech 100 Consolidates Near Highs Bull...

July 18, 2025

Market Insights

GOLD FOMC

December 18, 2024

Market Insights

Gold price posts modest gain amid trade...

February 26, 2025

Market Insights