US30 consolidates in a bearish pennant below 200 SMA, signaling potential for further downside

DOW JONES was down on Monday morning after testing the high level of 44157 in the last trading session as Friday’s weak jobs report showed nonfarm payrolls rose by just 73,000 in July, far below expectations, with prior months revised down by 258,000, pointing to a deeper labor market slowdown. Markets are now nearly fully pricing in a Fed rate cut in September, with over 63 basis points of easing expected by year-end.

Recent News

Bulls needs to step in Nasdaq as Large B...

October 28, 2024

Market Insights

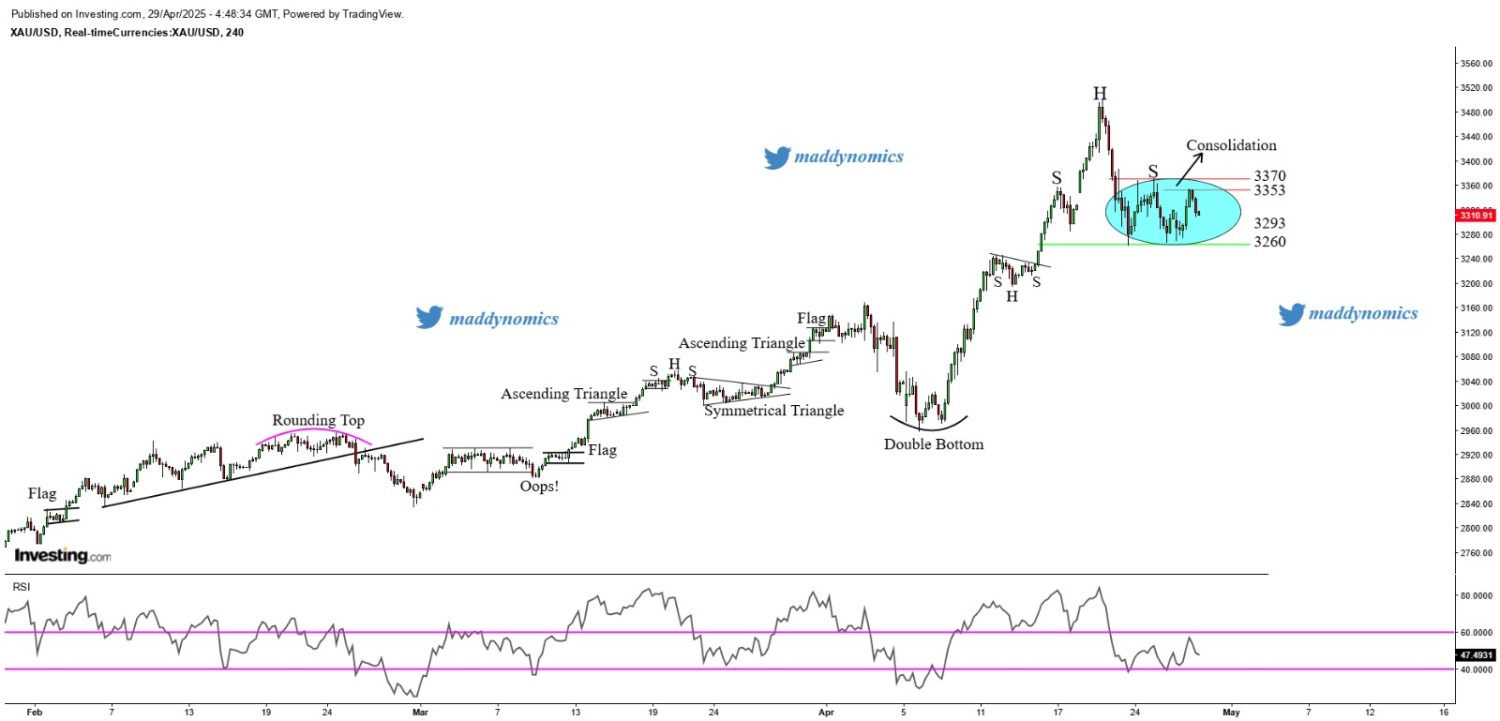

Gold consolidates but remains vulnerable...

April 29, 2025

Market Insights

Gold holds gains amid cautious sentiment...

July 16, 2025

Market Insights

NASDAQ 100 Aims for a Strong Breakout Ab...

October 24, 2025

Market Insights

NASDAQ making new ATH

December 18, 2024

Market Insights

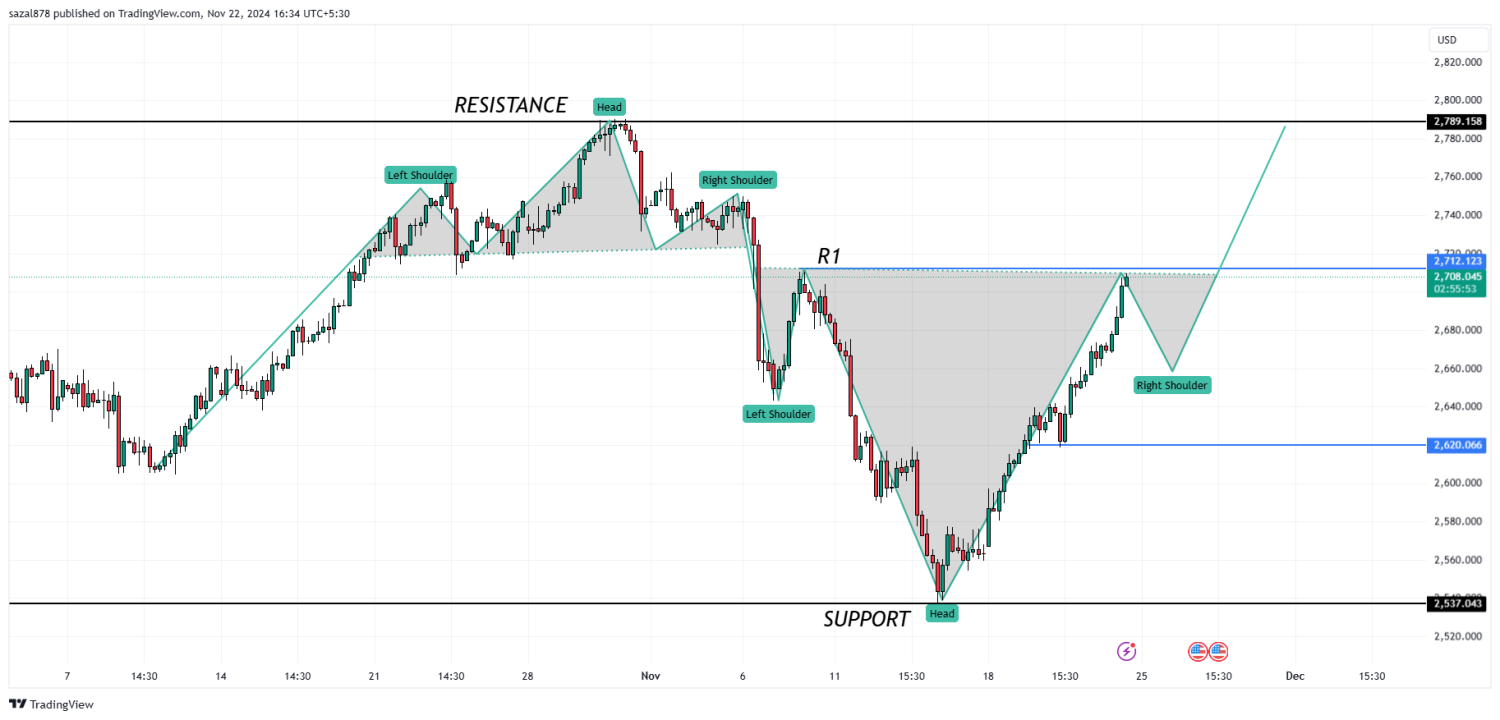

Gold Shines as Safe-Haven Amid Geopoliti...

November 22, 2024

Live Charts