Gold consolidates but remains vulnerable to renewed selling pressure

Gold prices slipped as much as 1% to $3305 an ounce after gaining 0.7% the previous day as signs emerged that President Donald Trump may ease auto-related tariffs. A White House official indicated that some levies on imported auto parts would be lifted and tariffs on cars, aluminum and steel might also be relaxed. The move dampened safe-haven demand for gold amid hopes of easing trade tensions. Meanwhile, a stronger U.S. dollar added further pressure, making gold more expensive for foreign buyers.

As the week advances, traders will keep a sharp eye on central bank remarks and forthcoming economic data, looking for signs of how the U.S. economy is shaping up. These insights could play a crucial role in determining gold’s near-term price direction. Amid ongoing economic volatility and the unresolved trade dispute, gold remains a key asset, maintaining its reputation as a safe haven during uncertain times.

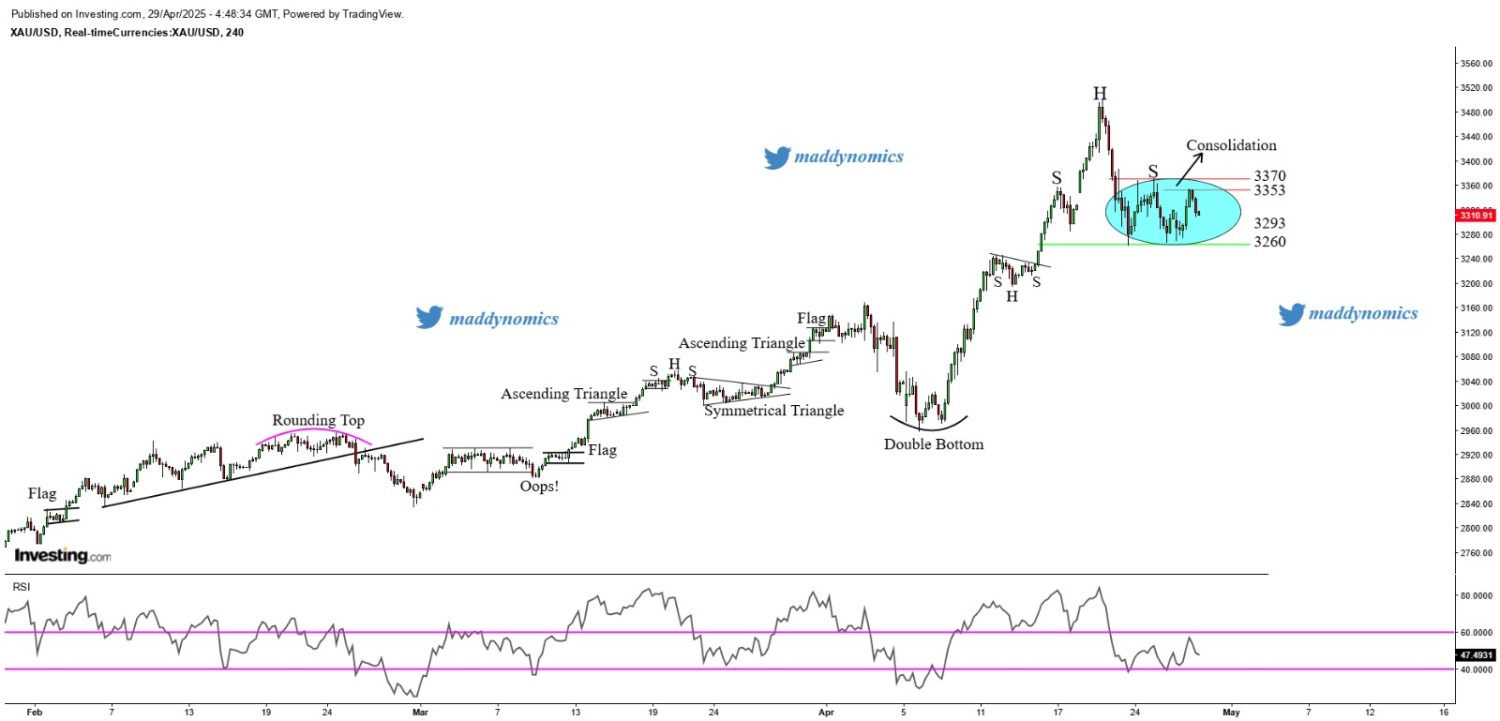

XAU/USD TECHNICAL OVERVIEW

Technical Structure: Gold is displaying mixed signals across multiple timeframes. On the daily chart, a Narrow Range 3 (NR3) candle and a Hanging Man pattern suggest potential exhaustion near recent highs. Price action on the 4-hour chart shows consolidation, indicating indecision. However, on the 15-minute chart, a breakdown from a Head & Shoulders pattern and the formation of a Bear Flag point to bearish momentum in the short term.

Intraday Trend/ Intraday Strategy: The short-term trend remains bearish/ Traders may look to sell near resistance levels or on breaks of key support levels.

Weekly Trend: Bullish

Major Resistance: 3322, 3337, 3353

Major Support: 3308, 3300, 3286

Recent News

Dow Jones Poised for a Powerful Breakout...

October 24, 2025

Market Insights

Gold price flat lines below $2,650 level...

December 03, 2024

Market Insights

Gold Glitters But Faces a Moment of Caut...

April 15, 2025

Market Insights

Gold pauses at crossroads amid Dollar st...

July 28, 2025

Market Insights

DAX Poised to Test Key Support Level

December 20, 2024

Market Insights

Crude Oil Faces Key Support at $60 Amid...

March 22, 2025

Market Insights