Time for caution in Gold & Bitcoin as Gravestone Doji appears on Weekly Charts.

The Gold price (XAU/USD) trades in positive territory on Monday and is up nearly 1% in late European session. The US presidential election risks and the ongoing Middle East geopolitical tensions are likely to underpin the yellow metal, a traditional safe-haven asset, in the near term.Nonetheless, the renewed Greenback demand and higher US bond yields might cap the upside for Gold price as higher yields make non-yielding assets like bullion less attractive in comparison.Investors will closely watch the looming US presidential election on Tuesday. The attention will shift to the US Federal Reserve (Fed) rate decision on Thursday. The uncertainty over the US election outcome is one reason markets assume the Fed will deliver a rate cut of the usual 25 basis points (bps) on Thursday, rather than repeat its outsized half-point easing.

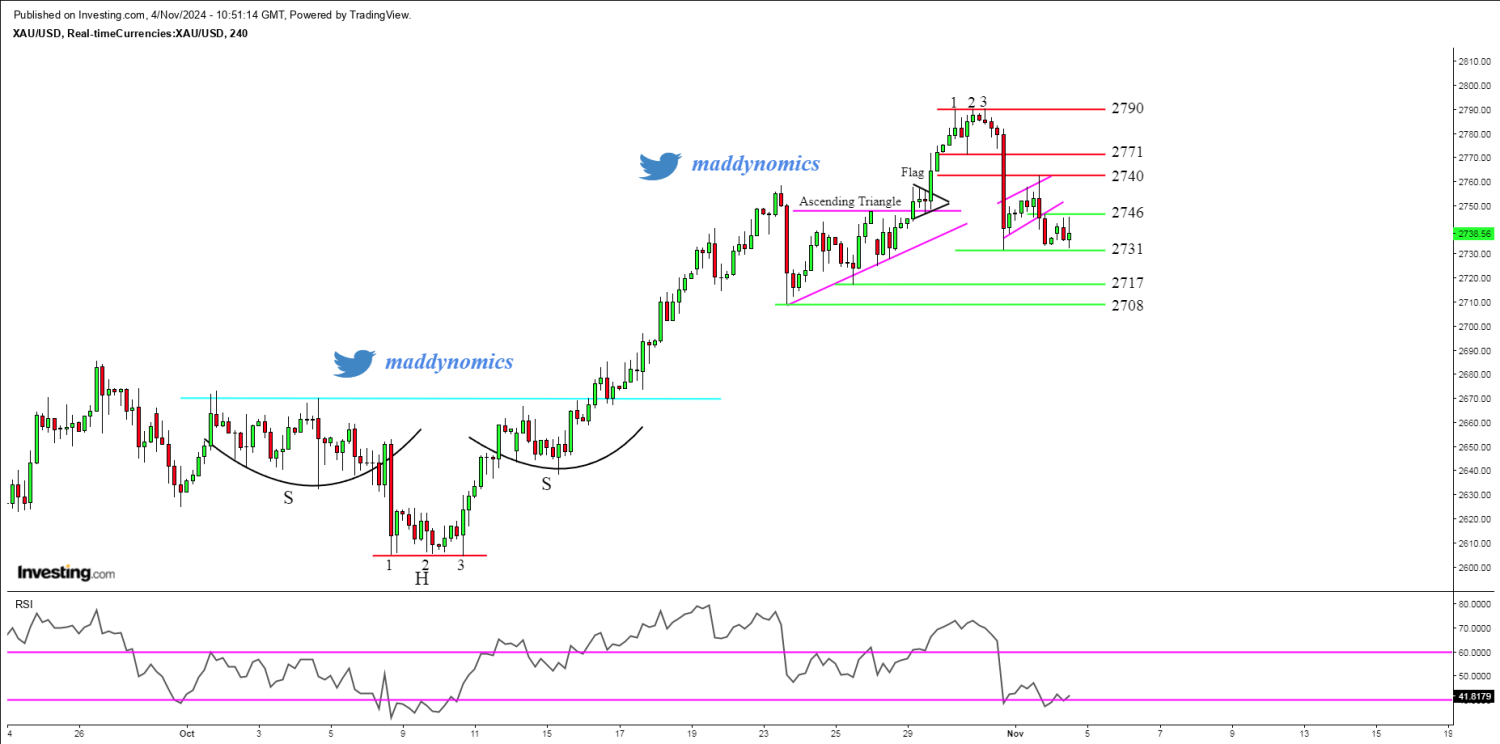

Technically, Gold has formed Gravestone Doji Candle Stick Pattern on Weekly Chart which is showing some sings of concern for Bulls. If Gold is able to break 2713$ on the down, it can retrace upto 2690-2695$ area where the 8 Weekly SMA is coming. Friday's High at 2762$ level will be a crucial level on the upside for bulls.

Gold Structure: Gravestone Doji on Weekly, Inverted Hammer on Daily, Rising Wedge on 4hr, Bullish Flag on 15 min.

Intraday Strategy/ Intraday Trend: Buy on Support,Sell on Resistance/ Neutral

Weekly Trend: Bullish

Major Resistance: 2744,2748, 2754,

Major Support: 2737,2731,2718

Recent News

XAG/USD at 12 year high, XAG/USD rises a...

October 22, 2024

Market Insights

Gold Weekly Chart Momentum Holds Over 25...

June 28, 2025

Market Insights

Gold price moves away from one-week top...

November 20, 2024

Market Insights

Crude Oil Under Pressure: Testing Major...

February 22, 2025

Market Insights

Gold attracts buyers in early European S...

October 24, 2024

Market Insights

Gold Daily Chart Analysis: Strong Reboun...

March 05, 2025

Market Insights