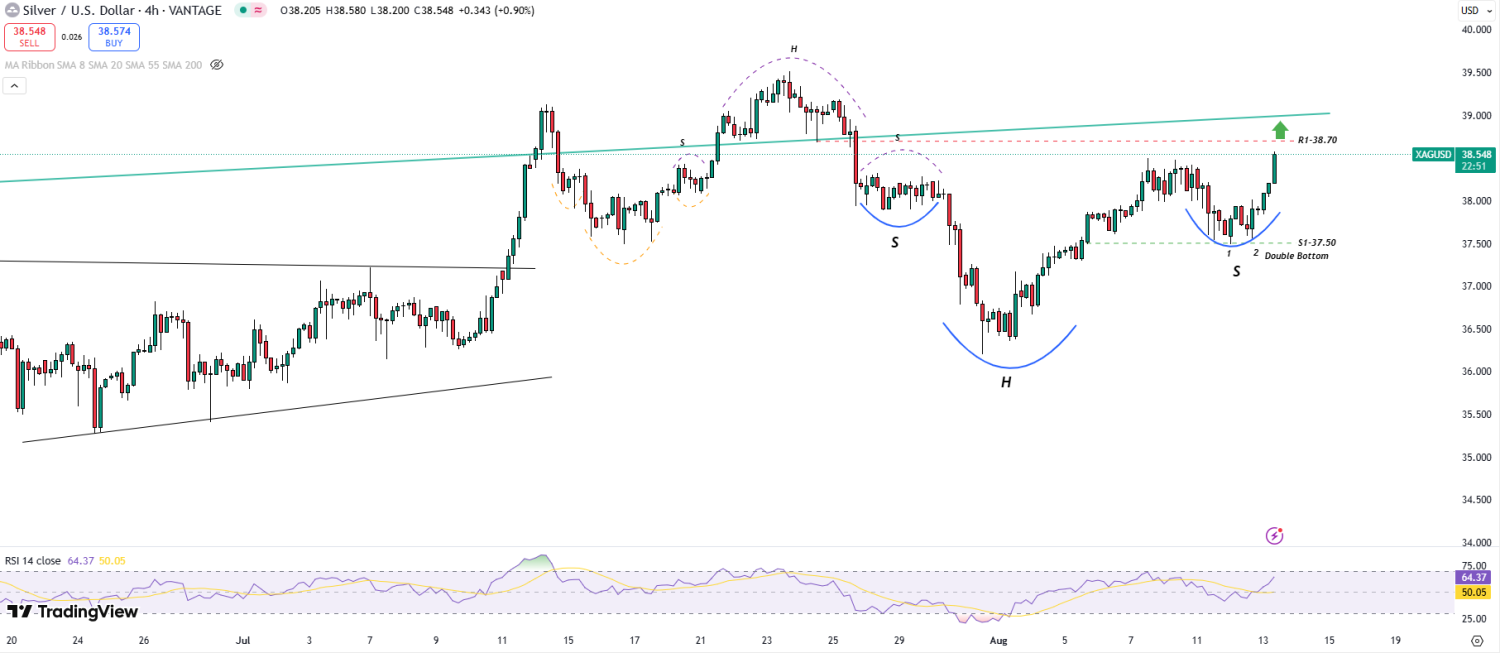

Silver forms massive Inverted Head & Shoulders at 1-Year channel resistance — Major Breakout Looms!

ChatGPT said:

Recent News

NASDAQ making a Bullish Flag in 1HR time...

May 08, 2025

Market Insights

Gold sellers take a brief pause ahead of...

May 13, 2025

Market Insights

DAX making a Wedge pattern

December 30, 2024

Market Insights

US30 Breaks Out of Bullish Flag Pattern...

May 05, 2025

Market Insights

WTI Crude Rejected from Trendline Resist...

July 26, 2025

Market Insights

Natural Gas 4 Hour Chart Pinpointing the...

March 03, 2025

Market Insights