Silver forms massive Inverted Head & Shoulders at 1-Year channel resistance — Major Breakout Looms!

ChatGPT said:

Recent News

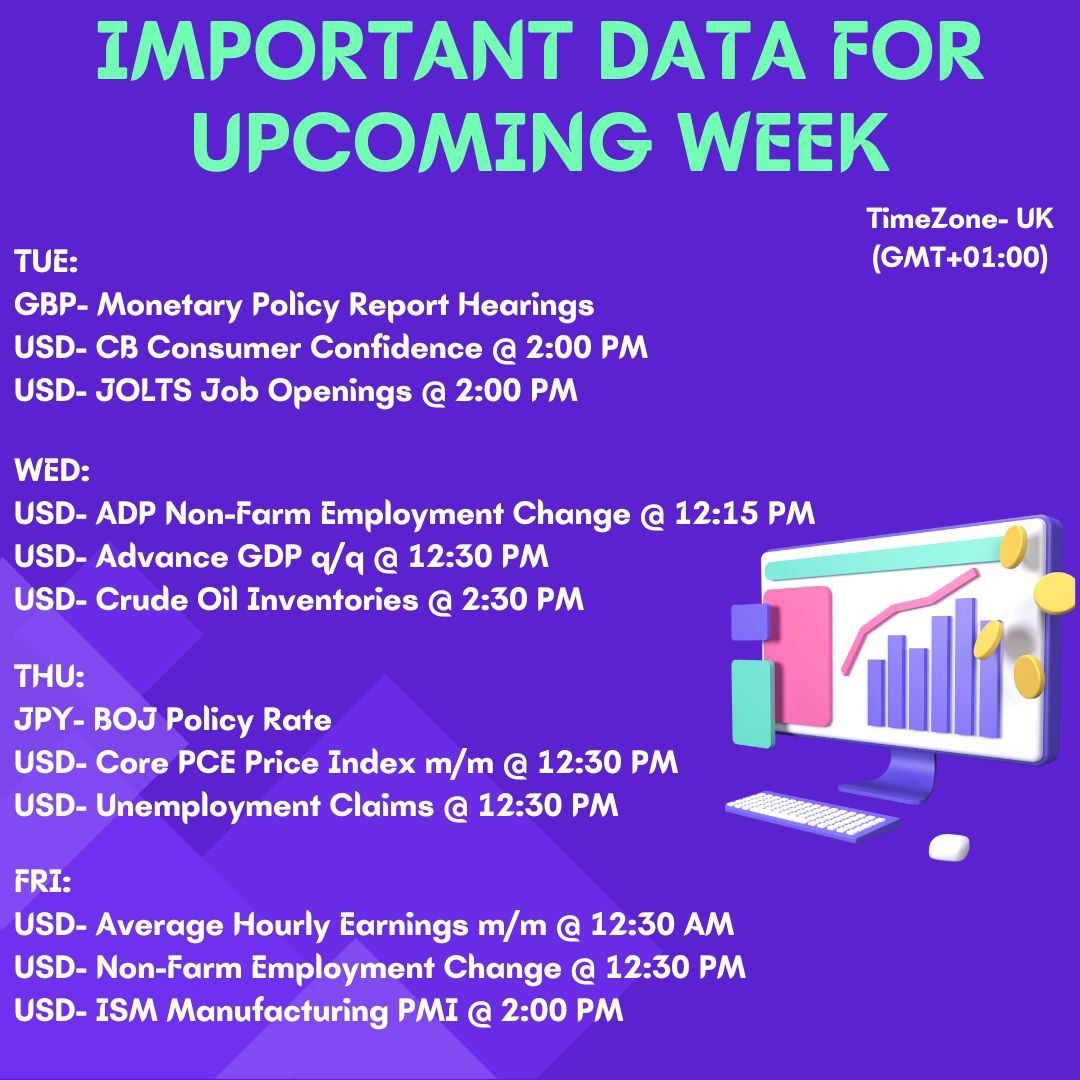

IMPORTANT DATA's FOR THIS WEEK

October 28, 2024

Market Insights

NASDAQ making new ATH

December 18, 2024

Market Insights

Gold Price Update: Weekly Decline Amid H...

December 20, 2024

Live Charts

Gold stalls at $3,345 ahead of US CPI– W...

June 11, 2025

Market Insights

Gold tests the Top – Breakout from Desce...

July 11, 2025

Market Insights

Crude Oil Under Pressure: Testing Major...

February 22, 2025

Market Insights