Gold stalls at $3,345 ahead of US CPI– Will bulls break through or back off?

Gold is fluctuating within a tight range, swinging between $3,345 and $3,330 as it struggles to find clear direction on Wednesday. A cautious market response to the US-China trade deal, coupled with investor wariness ahead of the upcoming US CPI data, is offering some support to gold prices, which are struggling to sustain gains beyond the $3,345 level.

While both countries agreed on a "framework" to ease trade tensions and reaffirm last month’s Geneva consensus, the lack of concrete details has sparked doubts about the agreement’s longevity, leading to a muted reaction in financial markets.

Attention now shifts to the US CPI report due later today, which could reveal the inflationary effects of the recently imposed Trump tariffs. An upside surprise in inflation might revive deflation concerns and potentially increase bearish pressure on the US Dollar, further impacting gold's direction.

XAU/USD TECHNICAL OVERVIEW

Technical Structure: Gold is exhibiting a mixed yet overall bullish technical setup. On the daily chart, a Doji candle signals indecision, but the price is holding above the 20-day SMA, suggesting underlying strength. The 4-hour chart shows an Ascending Triangle, typically a bullish continuation pattern, indicating a potential breakout higher. On the 1-hour timeframe, Gold is forming a Bullish Flag, which supports the near-term bullish outlook.

Intraday Trend/ Intraday Strategy: The intraday trend remains bullish to neutral and favours the strategy of Buying on 3330-3332 Support zone and Selling on 3345-3340 Resistance zone. Breakout should be expected above 3350.

Weekly Trend: Neutral

Major Support: 3320, 3295, 3271

Major Resistance: 3350, 3375, 3402

Recent News

Gold surged to another record peak amid...

April 16, 2025

Market Insights

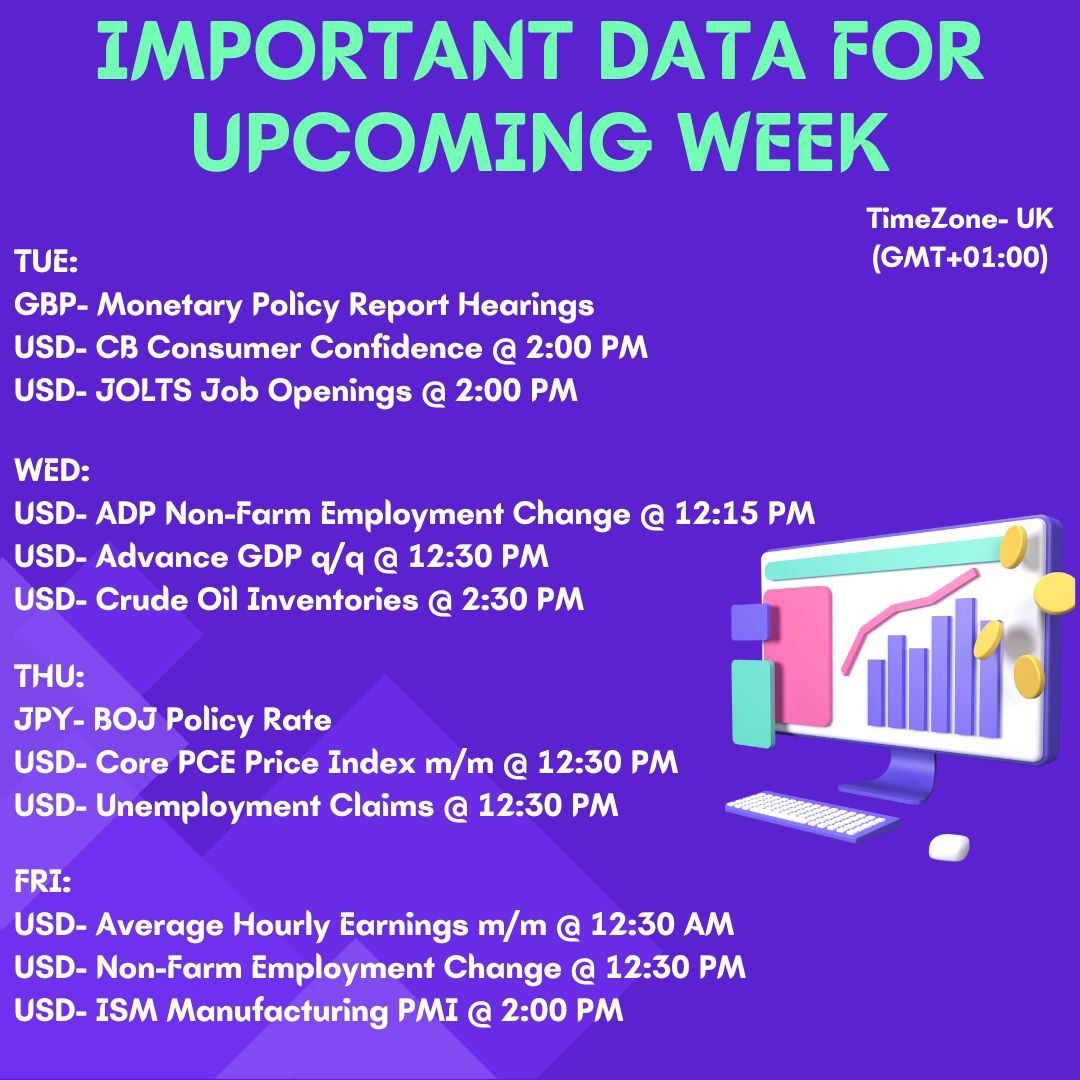

IMPORTANT DATA's FOR THIS WEEK

October 28, 2024

Market Insights

US Tech 100 Eyes Breakout Bullish Flag i...

April 02, 2025

Market Insights

Gold at a crossroad: RSI Divergence is s...

August 28, 2025

Market Insights

Resistance Retest – Breakout or Pullback...

February 19, 2025

Market Insights

US30 Breaks Out of Bullish Flag Pattern...

May 05, 2025

Market Insights