Gold soars to unprecedented highs driven by trade uncertainties and a subdued US dollar.

Gold prices surged to a new record on Monday as the dollar continued to weaken, while stocks showed mixed performance amid concerns over Donald Trump's tariff actions and his escalating conflict with the Federal Reserve.

On April 2, U.S. President Donald Trump announced 'reciprocal tariffs' on multiple countries. While the administration has delayed some levies, the trade tensions with China are escalating.

Meanwhile, Trump ramped up his criticism of Federal Reserve Chair Jerome Powell, with reports indicating his team is evaluating the possibility of removing him from office.

Investors have flocked to safe haven assets like Gold amid rising economic uncertainty across the board. Furthermore, central banks have been steadily increasing their gold reserves, with China, the world's largest gold consumer, adding to its holdings for the fifth consecutive month.

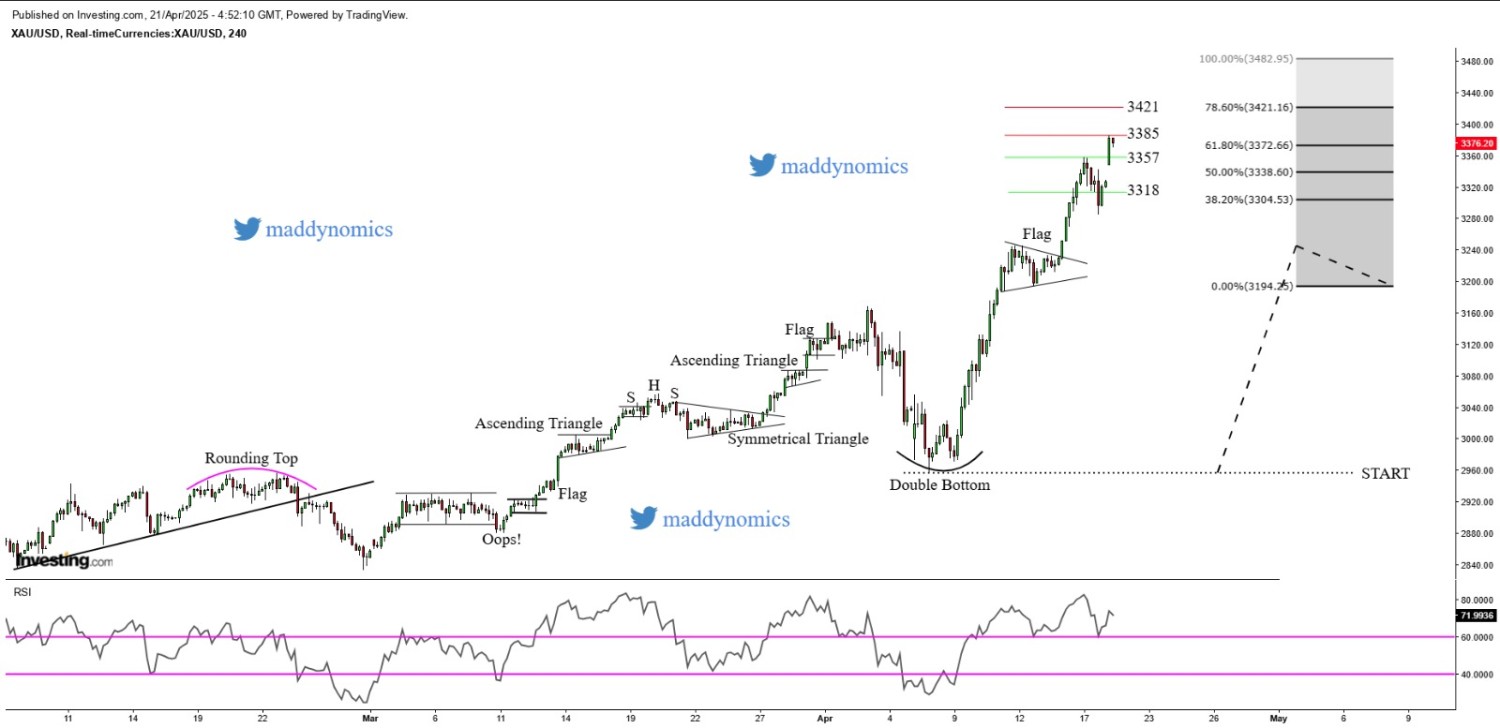

XAU/USD TECHNICAL OVERVIEW

Technical Structure: Gold is currently experiencing a strong upward trend, with a parabolic advance observed on the weekly chart, indicating an ultra-bullish market. On the daily timeframe, a breakout of a Doji candle further supports the bullish sentiment. Additionally, a bullish Marubozu pattern on the 4-hour chart confirms the strength of the rally. The Daily RSI stands at 75.93, which typically signals an overbought condition, yet there are no clear signs of a correction at this time, indicating that the bullish trend remains intact for now.

Intraday Strategy/ Intraday Trend: Buy on Supports, Buy on Breakouts/ Bullish

Weekly Trend: Ultra Bullish

Major Resistance: 3390, 3400, 3421

Major Support: 3357, 3330, 3314

Recent News

GBPUSD making a Bearish Flag

November 21, 2024

Market Insights

US30 Forms Bearish Pennant Below Key Sup...

July 16, 2025

Market Insights

Gold price rises to multi-day high, near...

July 01, 2025

Market Insights

🌟 CPI Data Release Today: Key Market Wa...

November 13, 2024

Live Charts

DOW JONES bounces back from daily suppor...

February 27, 2025

Market Insights

Gold prices struggle to sustain above $2...

March 11, 2025

Market Insights