Gold & Silver trading sideways as Traders waiting Weekly Unemployment Claims & FOMC Decision.

Gold prices are trading with sideways bias($2663) on Thursday after profit booking from traders as Trump came victorious.

Silver is also not giving moves & currently trading at $3.15 down 0.08%. Gold price (XAU/USD) faced challenges as the dollar-denominated precious metals struggled due to a stronger US Dollar (USD).Gold prices are under pressure as safe-haven flows decline amid market optimism and “Trump trades.” This shift is driven by the clarity of a presidential victory, while the market had previously been anticipating a contested outcome.US Federal Reserve’s (Fed) policy decision will be eyed on Thursday. Markets expect a modest 25 basis point rate cut this week. This could provide support for Gold as lower interest rates reduce the opportunity cost of holding non-interest-bearing assets.

The CME FedWatch Tool shows a 98.1% probability of a quarter-point rate cut by the Fed in November.

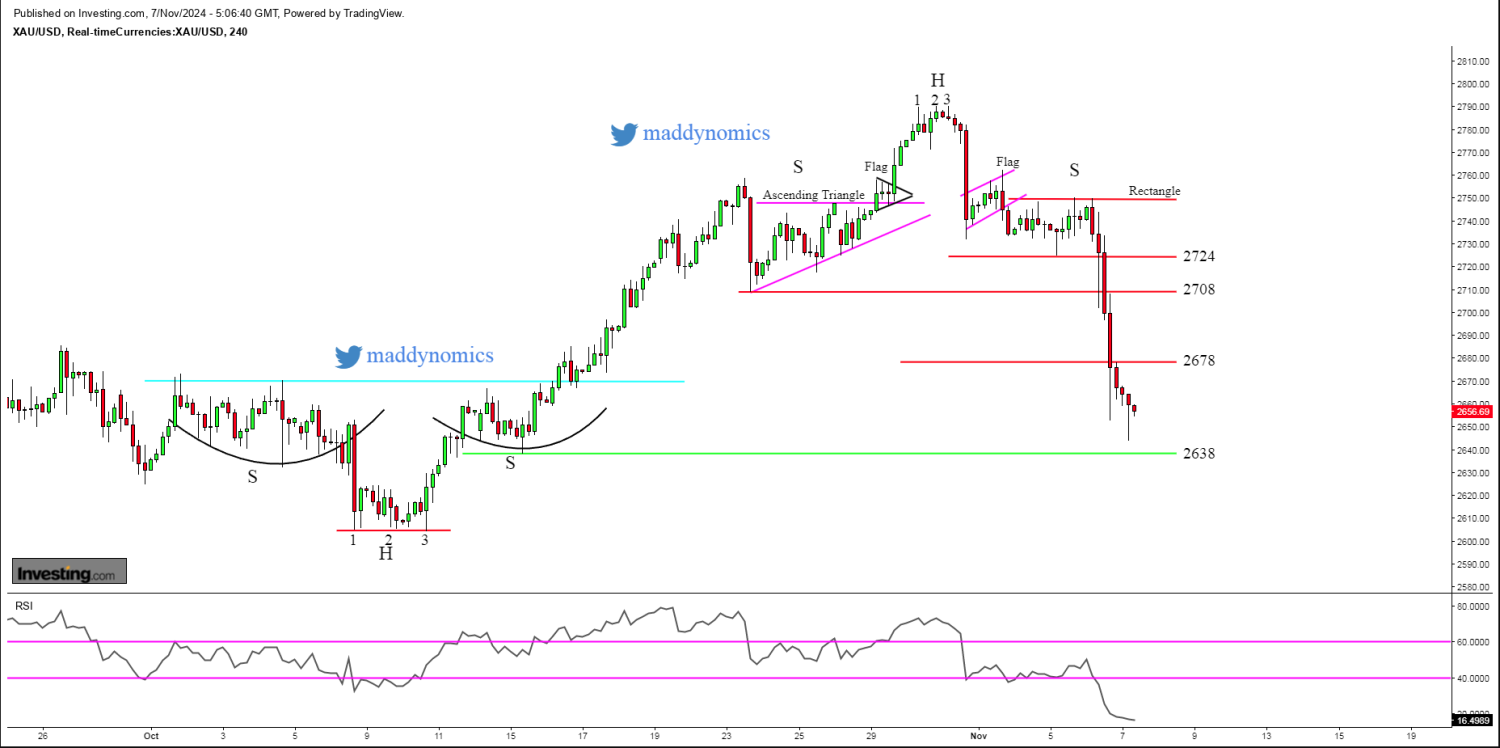

Gold Structure: Strong Bearish Candle on Daily, Breakdown from H&S on 4hr, Small RSI Divergence on 1hr.

Intraday Strategy/ Intraday Trend: Buy on Support,Sell on Rise/ Bearish

Weekly Trend: Neutral to Bearish

Major Resistance: 2664,2671, 2678

Major Support: 2653,2643,2626

Recent News

Gold 1 Hour Chart Analysis Bullish Break...

March 17, 2025

Market Insights

US Tech 100 Tests Key Resistance After B...

May 02, 2025

Market Insights

DOW JONES making a bullish flag in 1hr t...

August 13, 2025

Market Insights

GOLD TESTS ALL TIME HIGH RESISTANCE NEAR...

April 26, 2025

Market Insights

Gold erases its Asian session's gains bu...

June 04, 2025

Market Insights

Is Bitcoin at its turning point?

March 27, 2025

Market Insights