Gold price sticks to modest intraday gains, bulls seem cautious ahead of US PCE data

GOLD ANALYSIS & NEWS

Gold price sticks to modest intraday gains, bulls seem cautious ahead of US PCE data

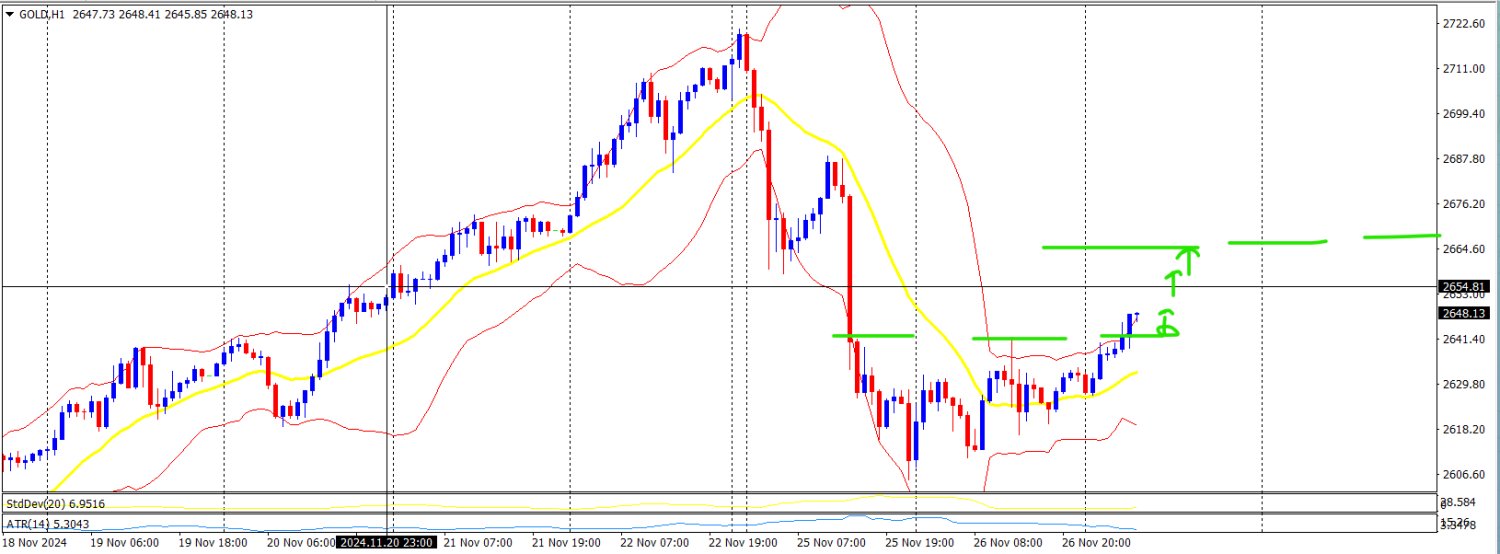

~Gold made a high of $2642 yesterday and then dropped to $2617.

~Gold took a reversal from $2617 zone and now trading in bullish territory.

~Gold is now trading in $2645-48 range, which is giving bullish indication.

Gold price benefits from trade war concerns as USD consolidates near weekly trough

Trump Tariffs: President-elect Donald Trump pledges to impose tariffs on all products from Canada, Mexico, and China, increasing demand for gold as a safe-haven asset.

Ukraine Conflict: Ukraine reports the largest Russian drone attack, with Russia using a hypersonic missile last week. Russian advances in Ukraine are the fastest since the 2022 invasion. North Korean troops are reportedly involved.

Escalating Tensions: Ukraine strikes deep inside Russia with Western-supplied missiles, raising the risk of further escalation in the conflict.

Middle East Ceasefire: US President Joe Biden announces a ceasefire deal between Lebanon and Israel, effective 02:00 GMT Wednesday.

WHAT'S EXPECTED IN GOLD TODAY?

1. Gold took a sharp reversal from Bearish Zone to Bullish zone. It corrects from $2617 and now trading around $2647.

2. Gold seems to be in BUY zone today. If Gold sustains above $2647 for sometime, Then it can test $2666-67 levels today.

3. If Gold manages to break $2667 levels, then we can see $2676-78 on radar as well.

Recent News

GOLD Profit Booking?

February 15, 2025

Market Insights

US Tech 100 Eyes Breakout Above 23,263 –...

July 24, 2025

Market Insights

Gold faces pressure amid renewed US-EU t...

May 27, 2025

Market Insights

After a parabolic move in Gold, Its time...

February 11, 2025

Market Insights

Gold on the Verge of Breakout Bullish Fl...

May 31, 2025

Market Insights

Nasdaq 100 Pulls Back from New ATH Resis...

September 11, 2025

Market Insights