Global Market Meltdown: Trade War Triggers Sell-Off Across Assets

Gold Slides 6% from All-Time High

Gold, typically a safe haven, dropped to a three-week low, down over 3% on Friday and 6% off its peak. Investors are selling to cover losses elsewhere as recession fears grip markets.

Oil Crashes 10% in a Week

WTI crude fell over 3% on Monday, after a 7% plunge Friday. With China hitting back with tariffs, oil demand forecasts are being slashed.

WTI lost 10.6%, Brent 10.9% last week—biggest weekly loss in months.

🇩🇪 DAX in Bear Market – Down 20%

Germany’s DAX fell to a 16-month low, now down 20% from its all-time high. Export-heavy European stocks are suffering as global trade slows.

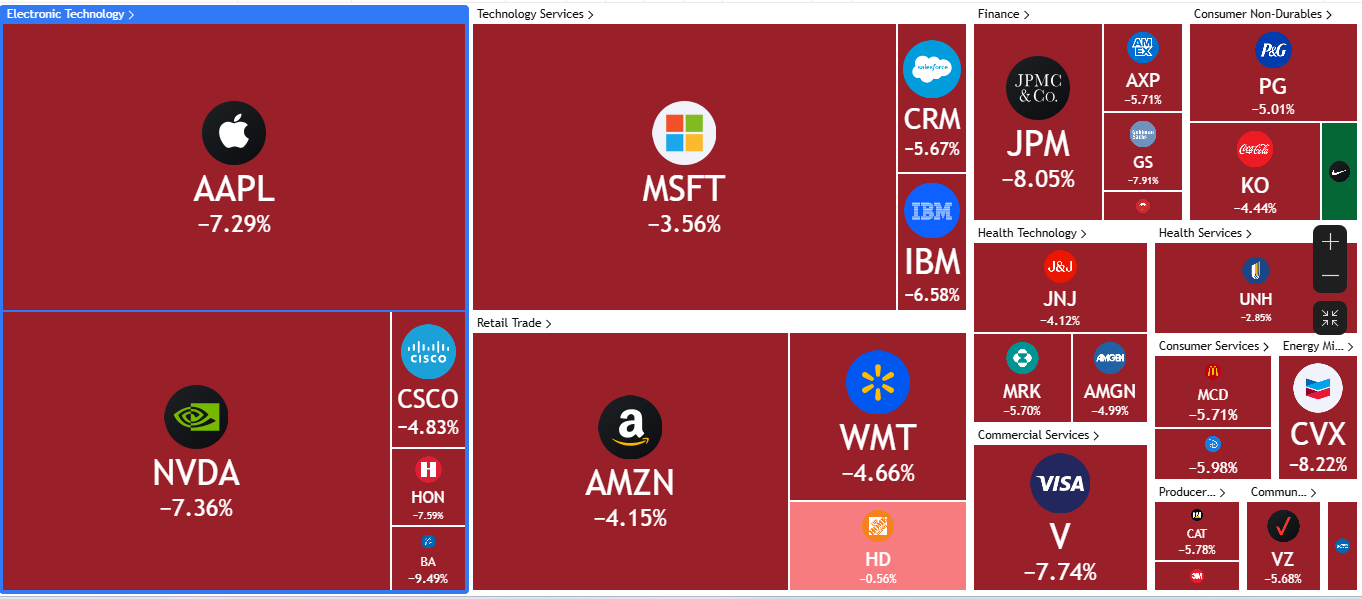

🇺🇸 Dow Jones Down 18% – Worst 3-Day Drop Since 1987?

Wall Street futures signal a major drop. The Dow is now 18% off its high, as President Trump doubles down on tariffs, ignoring market chaos.

What’s Next?

-

Expect more volatility across markets.

-

Gold may rebound if panic cools.

-

Oil remains under pressure.

-

Equities risk deeper losses unless trade tensions ease.

Recent News

US30 Forms Bullish Pennant Near Key SMA...

July 15, 2025

Market Insights

GBPJPY fall after Retail sales and PMI d...

November 22, 2024

Market Insights

Dow Jones Forms Bullish Reversal Near Ke...

June 19, 2025

Market Insights

US Tech 100 Rebounds from Support — Eyes...

August 06, 2025

Market Insights

Gold on the Brink: Awaiting NFP for the...

March 07, 2025

Market Insights

NASDAQ trading on all time higher levels...

August 13, 2025

Market Insights