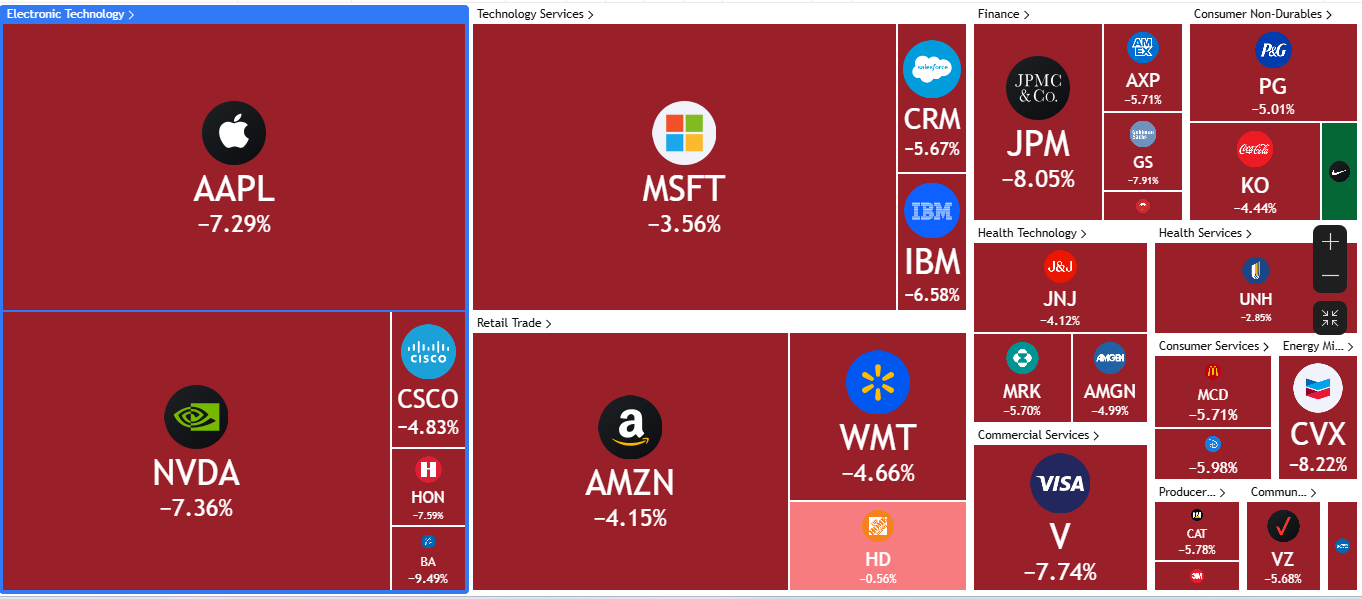

Global Market Meltdown: Trade War Triggers Sell-Off Across Assets

Gold Slides 6% from All-Time High

Gold, typically a safe haven, dropped to a three-week low, down over 3% on Friday and 6% off its peak. Investors are selling to cover losses elsewhere as recession fears grip markets.

Oil Crashes 10% in a Week

WTI crude fell over 3% on Monday, after a 7% plunge Friday. With China hitting back with tariffs, oil demand forecasts are being slashed.

WTI lost 10.6%, Brent 10.9% last week—biggest weekly loss in months.

🇩🇪 DAX in Bear Market – Down 20%

Germany’s DAX fell to a 16-month low, now down 20% from its all-time high. Export-heavy European stocks are suffering as global trade slows.

🇺🇸 Dow Jones Down 18% – Worst 3-Day Drop Since 1987?

Wall Street futures signal a major drop. The Dow is now 18% off its high, as President Trump doubles down on tariffs, ignoring market chaos.

What’s Next?

-

Expect more volatility across markets.

-

Gold may rebound if panic cools.

-

Oil remains under pressure.

-

Equities risk deeper losses unless trade tensions ease.

Recent News

Stronger Dollar weighs on Gold amid Fed...

July 17, 2025

Market Insights

NASDAQ making a bullish flag on all time...

October 07, 2025

Market Insights

GBPUSD Analysis

October 11, 2024

Market Insights

Gold at an inflection point as it tests...

April 28, 2025

Market Insights

Nasdaq 100 Futures Poised for Breakout E...

April 14, 2025

Market Insights

US Tech 100 Eyes Breakout Above 23,263 –...

July 24, 2025

Market Insights