Gold nears $3400 as Fed uncertainty and trade tariff tensions stir safe-haven demand

Gold prices slipped to around $3,380 on Tuesday but stayed near a five-week high, as markets remain cautious ahead of the August 1 tariff deadline set by President Trump. The focus is on ongoing US-EU trade negotiations, with the threat of a 30% tariff on EU exports looming. In response, the EU is reportedly preparing a broader set of retaliatory measures should talks fail.

On the monetary front, the European Central Bank is expected to keep rates steady at 2.0% after recent cuts, while the US Federal Reserve's policy decision is due next week. Investors are closely watching for comments from Fed Chair Jerome Powell and Governor Michelle Bowman later today for any hints on the Fed’s future rate path.

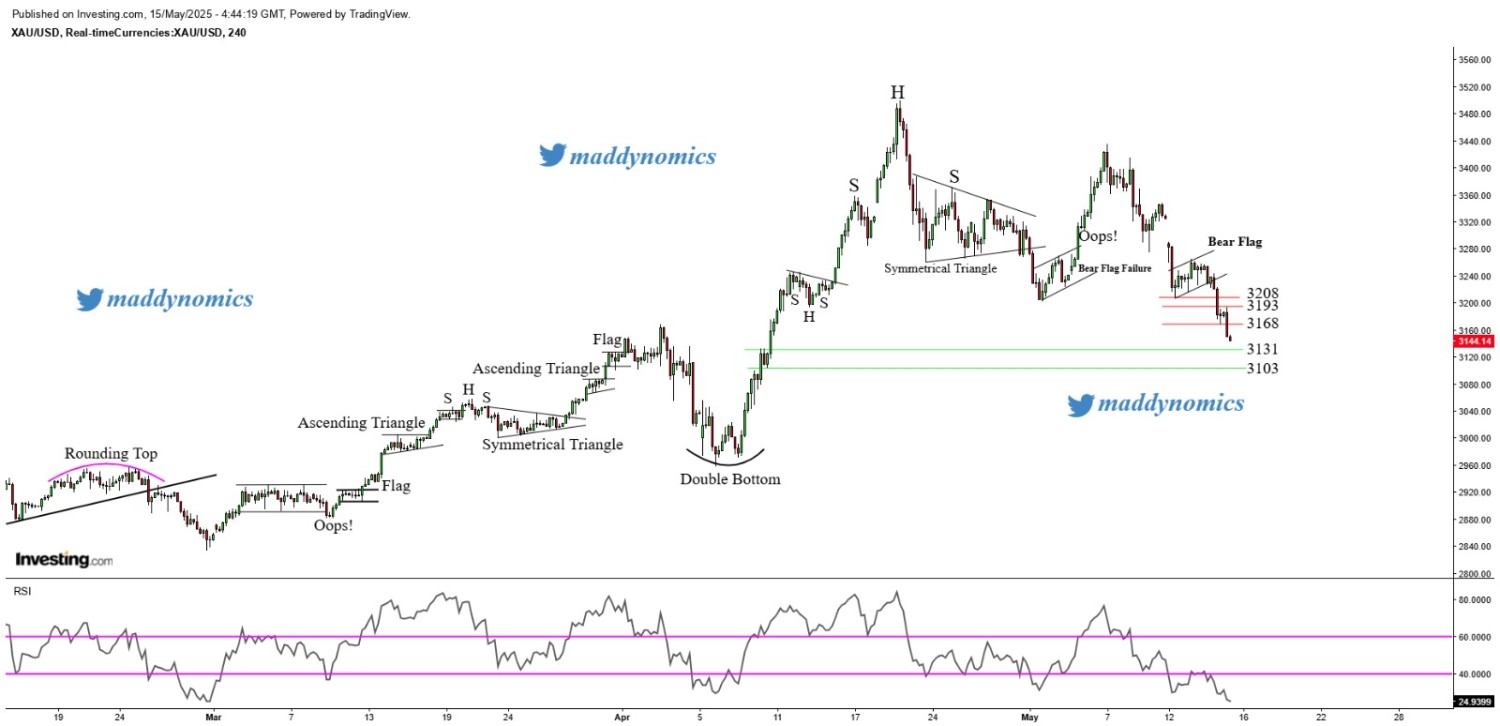

XAU/USD TECHNICAL OVERVIEW

Technical Structure: Gold is exhibiting strong bullish momentum following a consolidation breakout on the daily chart, supported by sustained trading above the 20-day SMA, reinforcing the medium-term uptrend. On the 4-hour chart, a bullish flag pattern signals potential continuation, while the 1-hour timeframe shows consolidation, hinting at accumulation before next leg higher.

Weekly Trend: Uptrend

Intraday Trend/ Intraday Strategy: The intraday bias remains bullish and favours the strategy of Buying on Dips and Buying on Resistance Breakout

Major Support: 3375, 3365, 3345

Major Resistance: 3402, 3422, 3440

Recent News

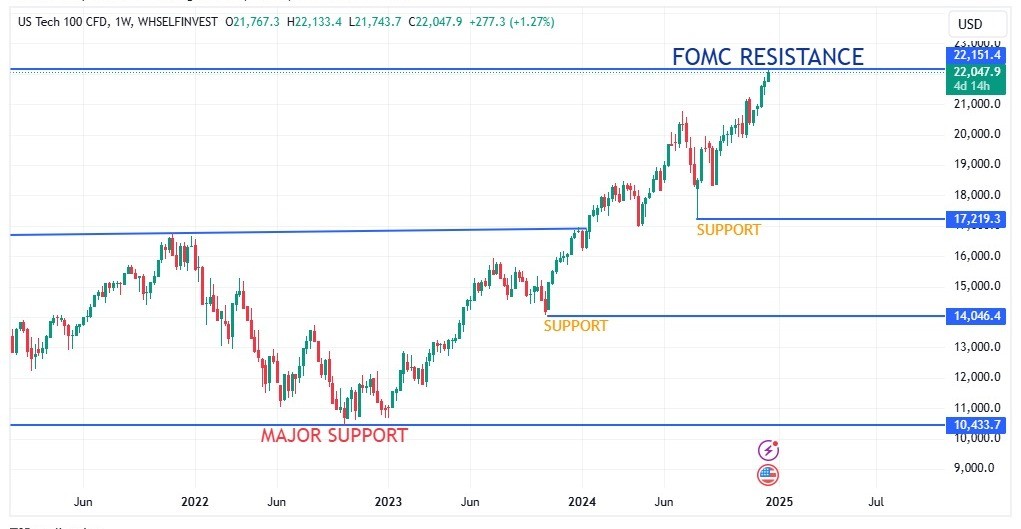

NAS100 Maintains Bullish Momentum Above...

August 08, 2025

Market Insights

NASDAQ making new ATH

December 18, 2024

Market Insights

Dow Jones Industrial Average struggles t...

December 17, 2024

Live Charts

Oil Prices Extend Losses Amid Recession...

March 11, 2025

Market Insights

Gold plunges to a one-month low, clings...

May 15, 2025

Market Insights

US Tech 100 Crashes Below Key Support Be...

April 04, 2025

Market Insights