Gold plunges to a one-month low, clings to 55-DSMA support

After hitting a record high of $3500 on April 22nd, Gold has shed as much as 10% and dropped to a one month low of $3130 with easing geopolitical tensions. Recent reconciliation between USA and China regarding the intense trade dispute continues to drive investors away from the safe-haven, hurting the yellow metal in the process. Furthermore, US 10 year treasury yields spiked to the highest level in one month due to Fed's contractionary monetary stance, exerting pressure on Gold prices. Traders will be closely monitoring the Producer Price Index report due for today and Fed chair Jerome Powell's commentary to gain insights into monetary policy and economic projections which might influence the price trajectory.

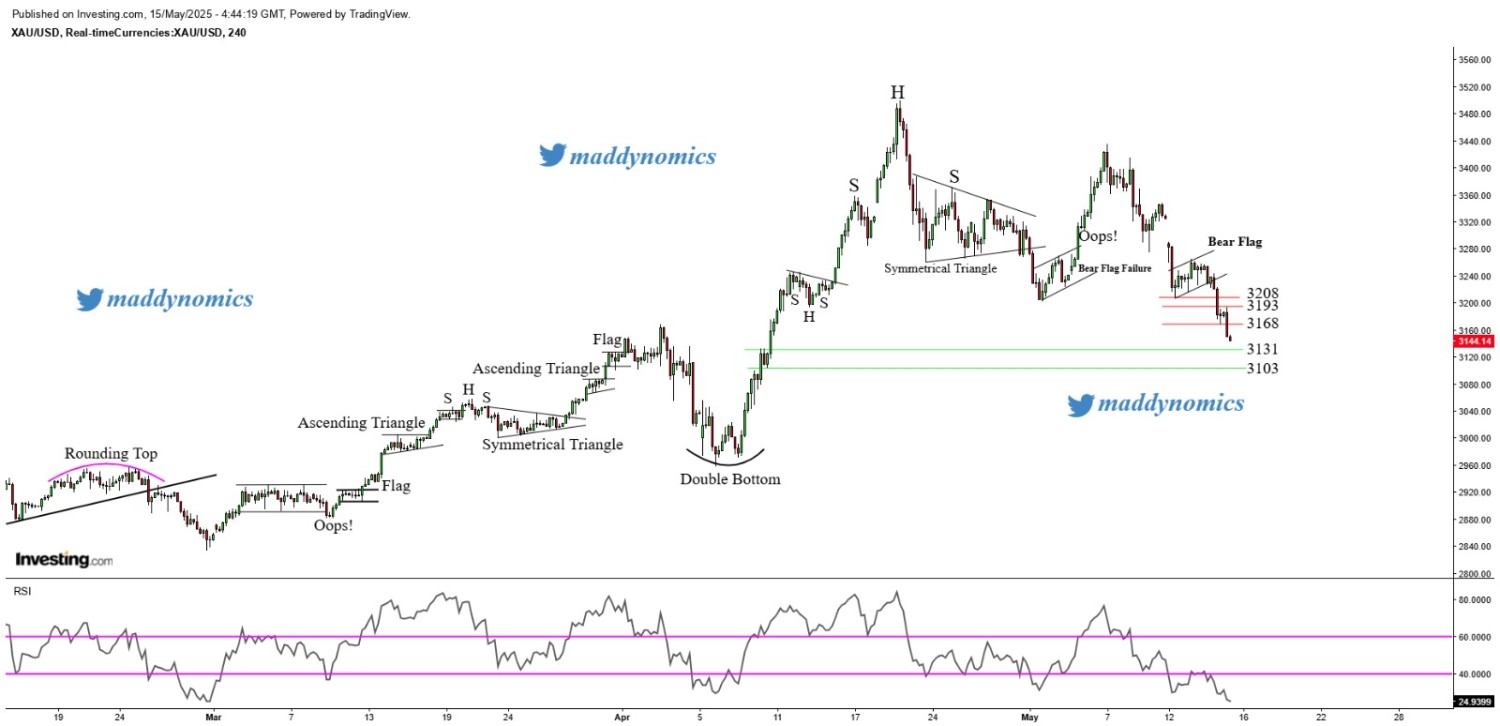

XAU/USD TECHNICAL OVERVIEW

Technical Structure: Gold extended decline for third session in a row which can be depicted by a Bearish Candle formed on the Daily chart. However, prices find support at 55-DSMA on the daily timeframe break of which would lead to further decline. 4-Hour chart displays Breakdown of a Bearish Flag, indicating that bearish biasness remains across multiple timeframes.

Intraday Trend/ Intraday Strategy: The intraday trend remains Bearish and favours the strategy of Selling on break of support and Selling on rise.

Weekly Trend: Bearish

Major Support: 3130, 3113, 3100

Major Resistance: 3156, 3165, 3175

Recent News

GBPUSD making a Bearish Flag

November 21, 2024

Market Insights

Gold Awaits NFP Breakout Key Levels in F...

March 07, 2025

Market Insights

NASDAQ made a Doji on higher levels

February 07, 2025

Market Insights

US Tech 100 Forms Bullish Pennant Eyes o...

July 23, 2025

Market Insights

US Tech 100 Eyes Bullish Breakout Above...

July 02, 2025

Market Insights

NASDAQ 100 (NAS100) Extends Rally Toward...

September 29, 2025

Market Insights