GBP/USD Aims for 1.3440 as Bullish Momentum Builds, But UK Jobs Data Looms

Technical Overview:

-

Support: 1.31382 and 1.27035

-

Resistance: 1.34417

-

Pattern: Bullish pennant near recent highs

Fundamental Drivers:

-

The British Pound remains cautious due to softening UK employment figures and moderating wage growth, which could limit further upside if confirmed in upcoming labor market reports.

-

On the flip side, the US Dollar (USD) is under pressure following softer-than-expected US inflation data, increasing expectations of a Fed rate cut later this year.

-

Geopolitical sentiment improved slightly as Donald Trump signaled improved US-China trade relations, calling them "excellent." This has helped weaken the USD further due to reduced demand for safe-haven assets.

Outlook:

If GBP/USD breaks above the current consolidation pattern, a test of 1.3440 appears likely. However, any downside surprise in upcoming UK employment data or hawkish tone from the Fed could bring the pair back toward 1.3138 support.

Recent News

DAX dips as earnings reports trigger a m...

October 30, 2024

Market Insights

Dow Jones Forms Bearish Pennant Near 45,...

August 26, 2025

Market Insights

GBPJPY facing a daily resistance

December 13, 2024

Market Insights

DOW JONES Doji on Daily, Trading Above 2...

September 16, 2025

Market Insights

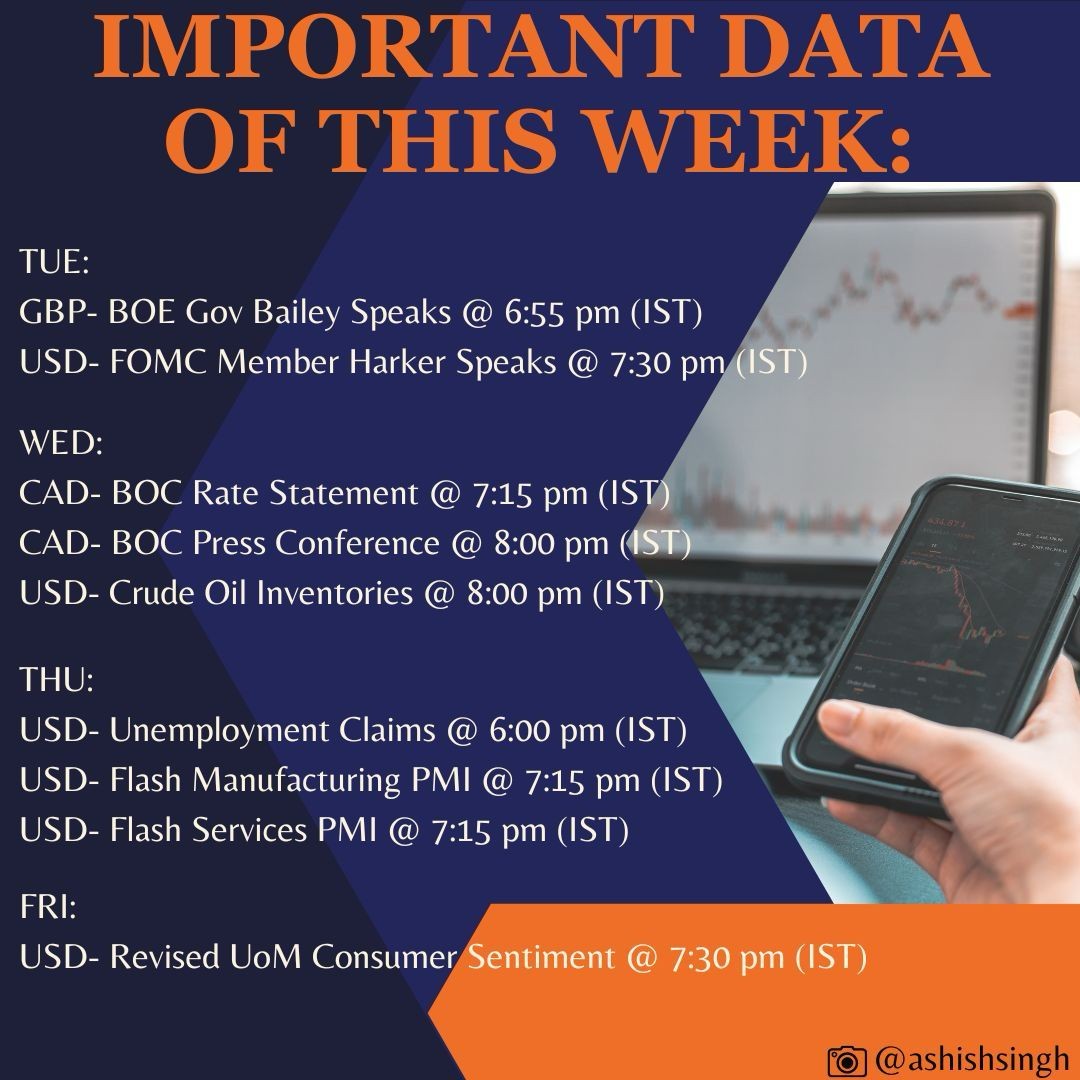

IMPORTANT DATA AND EVENT FOR THE WEEK

October 22, 2024

Market Insights

Can AUDUSD start a Multi-Month Bull run?

February 17, 2025

Market Insights