Bitcoin Bulls Target $83,000 Milestone Amid New ATH Surge

Key Levels and Technical Analysis

Fibonacci Extension Target: If BTC's rally holds, the next major level to watch is the 161.8% Fibonacci extension at $83,062, based on the July high of $70,079 and August low of $49,072. This target has become an anchor for bullish expectations, and any breakout above this level could signal further upside.

RSI Signals Overbought Conditions: The Relative Strength Index (RSI) currently reads 78, placing it well above the overbought threshold of 70. This signals that Bitcoin may be due for a potential cooldown. If the RSI dips back below 70, it could trigger selling pressure as traders look to lock in profits. However, if the rally continues with RSI staying elevated, this could indicate a sustained bullish trend.

Possible Scenarios for Bitcoin’s Next Move

- Continued Rally: Should Bitcoin maintain its momentum and close above $81,846, a test of $83,000 becomes increasingly likely.

- Pullback Risk: A close below the $78,000 mark would introduce the risk of a deeper retracement, potentially retesting support around $73,072.

Recent News

Dow Jones Trades in Descending Channel;...

August 22, 2025

Market Insights

Dow Jones Forms Bearish Flag Eyes Suppor...

March 04, 2025

Market Insights

Dow Jones 1Hour Chart Wedge Formation Ne...

March 17, 2025

Market Insights

DOW JONES ANALYSIS

November 15, 2024

Live Charts

Gold 1 Hour Chart Analysis Bullish Break...

March 17, 2025

Market Insights

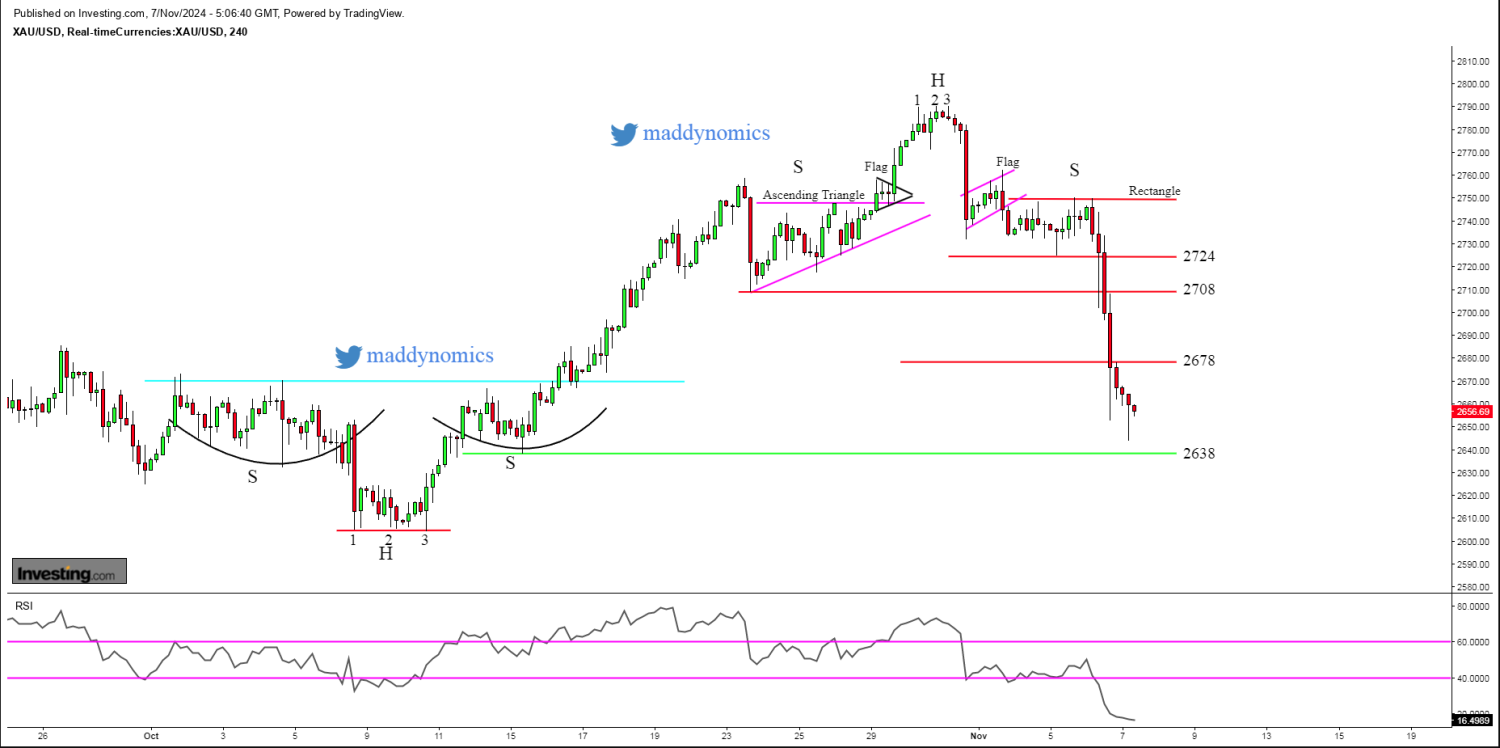

Gold & Silver trading sideways as Trader...

November 07, 2024

Market Insights