Gold Slips to One-Month Low Amid Strong Dollar and Shifting Investor Sentiment

Key Factors Pressuring Gold:

Strengthening US Dollar

The rising dollar has made gold less attractive for holders of other currencies, adding downward pressure on the precious metal. A strong dollar typically weakens demand for gold, as it becomes more expensive for foreign investors.Risk Appetite Shift

Investors appear to be moving toward riskier assets, influenced by market anticipation of fiscal strategies and monetary policy adjustments under Trump’s administration. Historically, pro-growth policies and fiscal expansion can boost the dollar and reduce the appeal of gold as a safe haven.Technical Analysis – Key Levels

The chart shows a resistance level around $2,710, where gold prices previously struggled to break through, indicating strong selling pressure. With gold now hovering near the support level of $2,605, this area could serve as a base for a potential reversal if it holds. However, a break below this support could lead to further declines, signaling weaker momentum for the metal.

Recent News

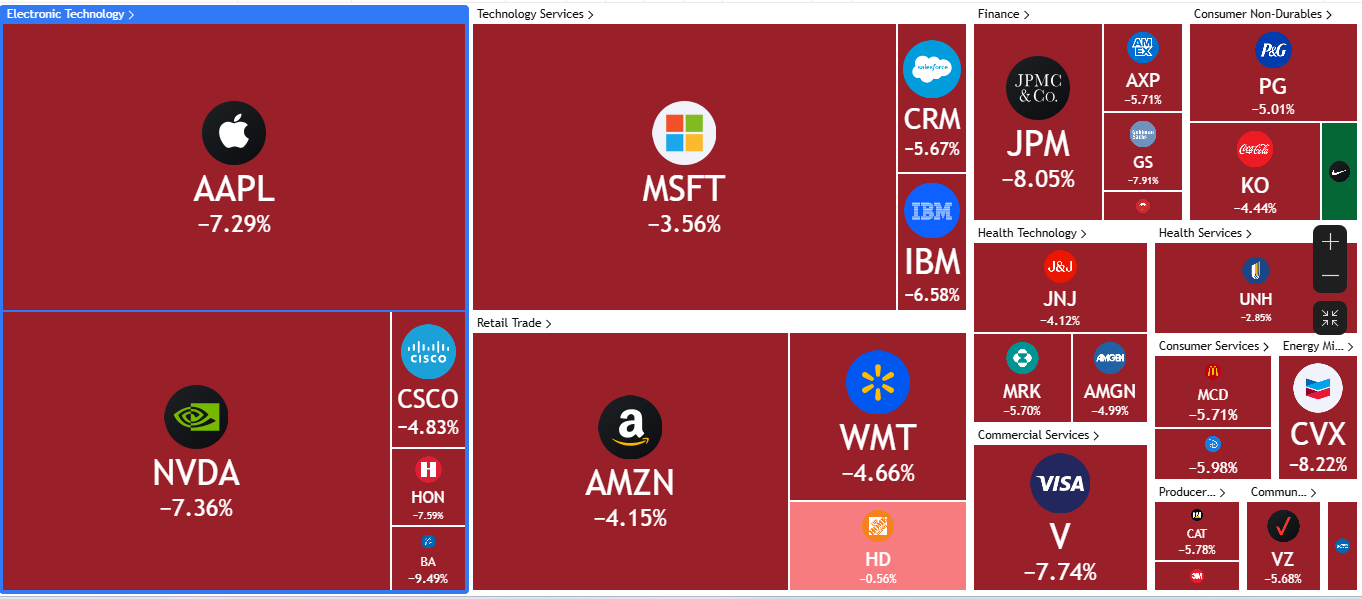

Global Market Meltdown: Trade War Trigge...

April 07, 2025

Market Insights

DOW JONES making a Bullish Flag in One H...

April 01, 2025

Market Insights

Gold Price Analysis: Bearish Reversal or...

February 21, 2025

Market Insights

US Tech 100 Tests $20,000 Support Amid B...

March 07, 2025

Market Insights

Dow Jones Futures Testing Key Support Le...

April 10, 2025

Market Insights

DOW JONES ANALYSIS

November 07, 2024

Market Insights