Natural Gas and Oil Forecast: How Kurdistan Exports Impact Global Supply

Natural gas and oil prices are under pressure as geopolitical tensions continue to influence global energy markets. The prospect of resumed exports from Kurdistan’s oilfields has contributed to a downward trend, while ongoing diplomatic discussions aim to resolve broader international conflicts.

Market analysts suggest that increased supply from Kurdistan could ease global supply constraints, affecting crude prices. Additionally, sanctions impacting energy exports have disrupted supply flows, adding volatility to the market. Natural Gas (NG) is trading at $3.98, just below the pivot point at $4.02, which is a crucial level to watch. If prices break above $4.02, immediate resistance is at $4.27, with a potential move toward $4.48 if bullish momentum builds.

Conversely, a drop below $4.02 could trigger selling pressure, testing support at $3.81 and possibly dipping to $3.55.

The 50 EMA at $3.92 provides short-term support, while the 200 EMA at $3.51 indicates long-term strength. As long as prices stay above the 50 EMA, the outlook remains cautiously bullish. Watch for a break above $4.02 for bullish confirmation. A fall below $3.92 could signal a bearish reversal.

Recent News

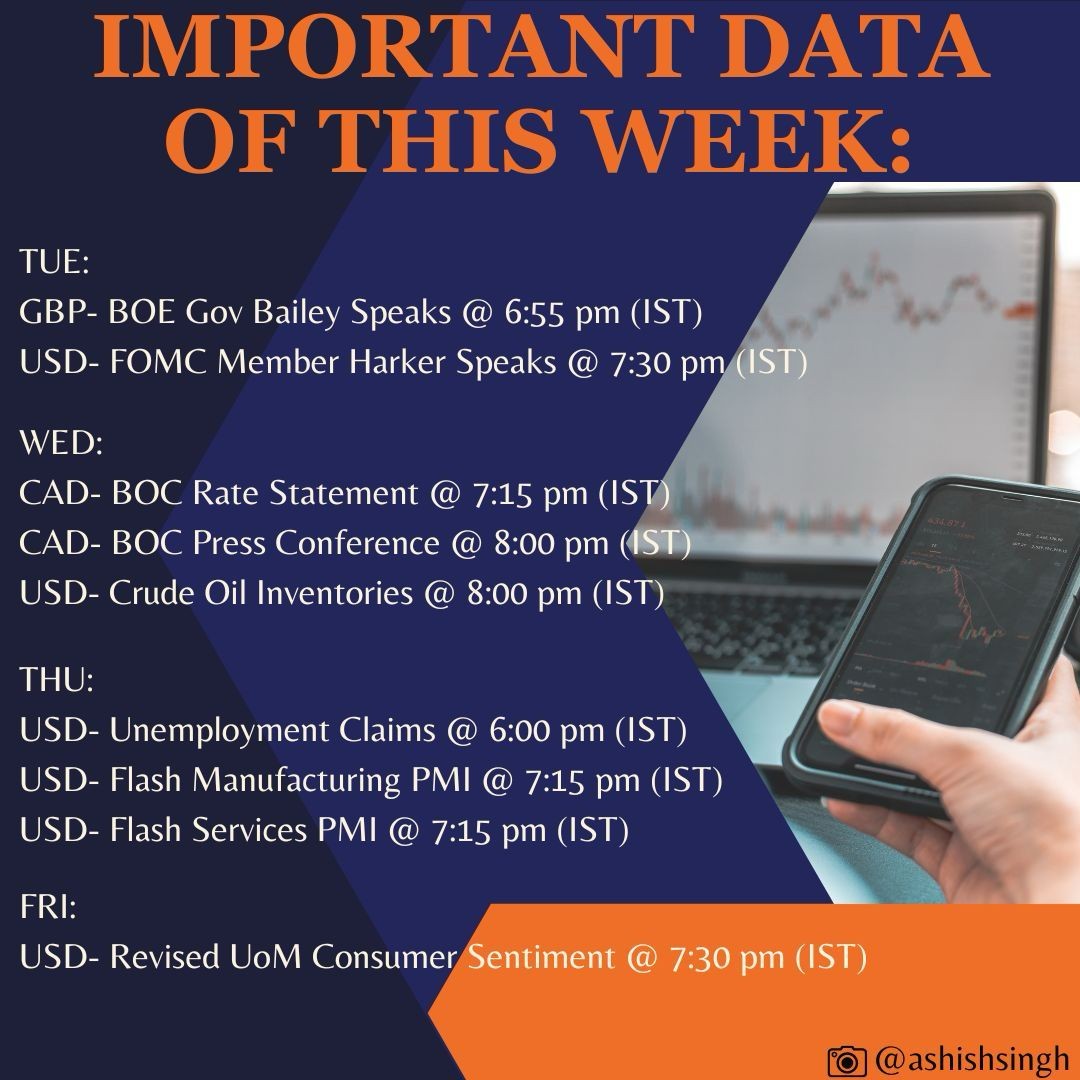

IMPORTANT DATA AND EVENT FOR THE WEEK

October 22, 2024

Market Insights

NASDAQ extends rally after breakout abov...

October 30, 2025

Market Insights

AUDUSD sustains on daily lower levels, w...

October 25, 2024

Market Insights

US100 forms bearish pennant near support...

August 04, 2025

Market Insights

Nasdaq 100 Futures Slide: Testing Suppor...

April 09, 2025

Market Insights

US Tech 100 Breaks Out of Downward Chann...

March 24, 2025

Market Insights