Gold witnesses modest recovery ahead of US NFP report

Gold exhibits signs of a temporary recovery but remains capped below the key $3260–$3265 resistance zone, previously a support area at the neckline of the head and shoulder pattern. During his recent speech at the Michigan rally, President Trump revealed potential trade deals with India, South Korea and Japan, emphasizing "no rush" as tariffs are benefiting the U.S. He also addressed China, warning that U.S. consumers might buy fewer goods but China bears the brunt of the trade war.

On Friday, China announced it is evaluating the possibility of initiating trade talks with the U.S. on reducing tariffs, following recent overtures from Washington, a step that could potentially ease the ongoing tariff dispute between the world’s two largest economies. Businesses and investors are closely monitoring developments for any indication that Washington and Beijing may roll back their high tariffs on each other’s goods, as fears mount that an extended trade standoff could severely impact the global economy.

Traders remain cautious ahead of the critical US Nonfarm Payrolls (NFP) report, which could shift Fed policy expectations and drive the next move in both USD and Gold.

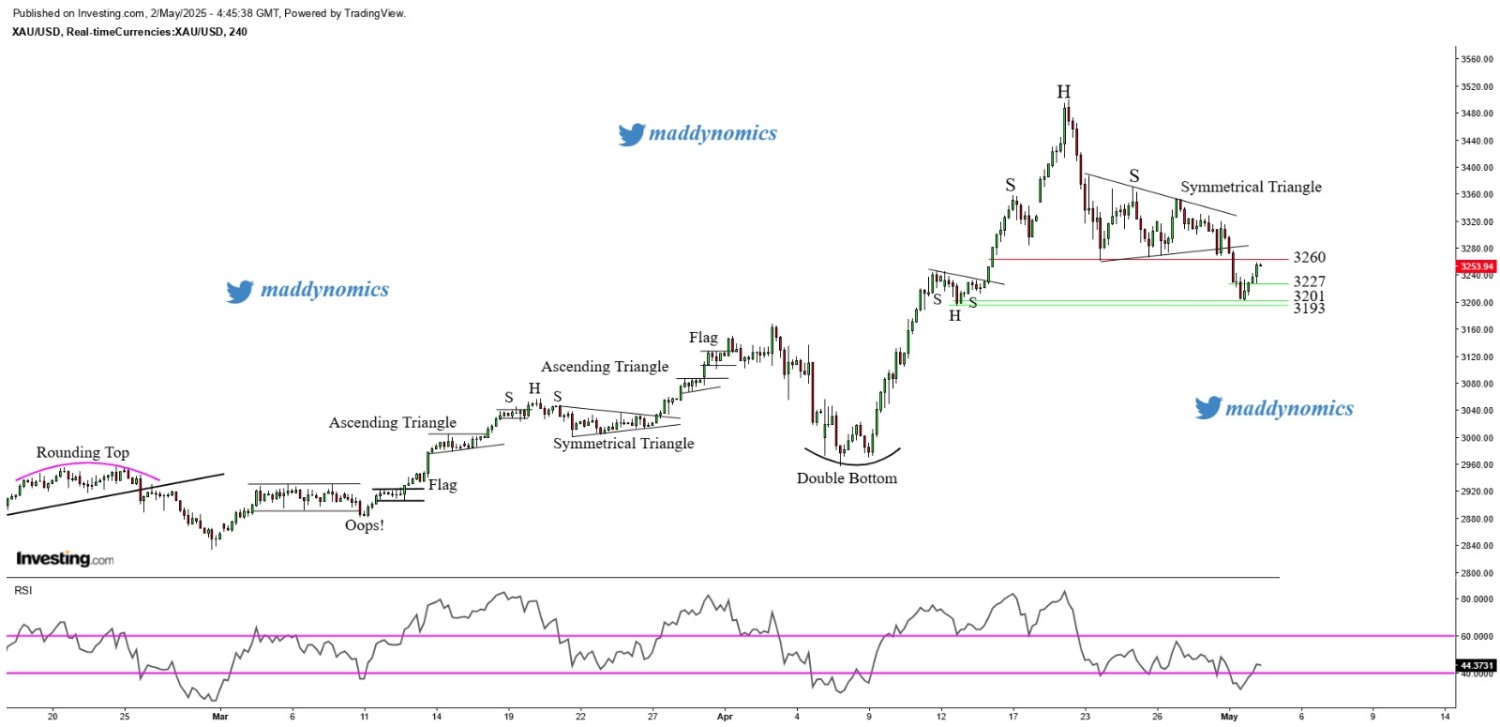

XAU/USD TECHNICAL OVERVIEW

Technical Structure: Gold formed a bearish daily candle, signaling short-term weakness. However, price is currently bouncing off the 20-day SMA, suggesting near-term support. On the 1-hour chart, an inverted Head & Shoulders pattern is developing, indicating a potential bullish reversal in the short term.

Intraday Strategy / Trend: The intraday bias is Bearish to Neutral, with a tactical approach to Buy on Supports and Sell on Resistances.

Weekly Trend: The broader weekly trend remains Neutral

Major Resistance: 3260, 3267, 3260, 3269

Major Support: 3244, 3235, 3225

Recent News

NASDAQ making bearish Flag

February 20, 2025

Market Insights

Dow Jones Analysis

October 14, 2024

Market Insights

DAX sharp fall after made a Doji Pattern

December 17, 2024

Market Insights

Gold holds steady below one-week high; b...

July 02, 2025

Market Insights

Dow Jones Chart Bullish Flag Formation N...

March 03, 2025

Market Insights

DAX bounce back from Daily Support leve...

November 20, 2024

Market Insights