Gold tumbled for third consecutive session on US-UK trade agreement

Gold prices extended decline below $3300 heading into Friday's trading session on growing optimism for a de-escalation in US-Sino trade war. US Treasury Secretary Scott Bessent and his Chinese counterpart are scheduled for high level trade talk in Switzerland this Sunday, taking the first step towards resolving the conflict perhaps. Ahead of the meeting, President Trump provided relief to China by hinting at lowering the 145% of tariffs levied on the country and lifting up the market sentiment. Furthermore, USA lifted steel and aluminium tariffs on UK and reduced car Import Tax to 10% under new trade deal announced by Trump. Trump's softening stance towards tariffs has taken a toll on the yellow metal.

Adding to the pressure, The Federal Reserve decided to hold its key interest rate unchanged as widely expected, citing inflation concerns and growing unemployment in near future if sweeping tariffs sustain. Maintaining a cautious stance, Fed chair Jerome Powell reiterated that the central bank is not considering a rate cut which boosted the US Dollar and weighed down on Gold prices.

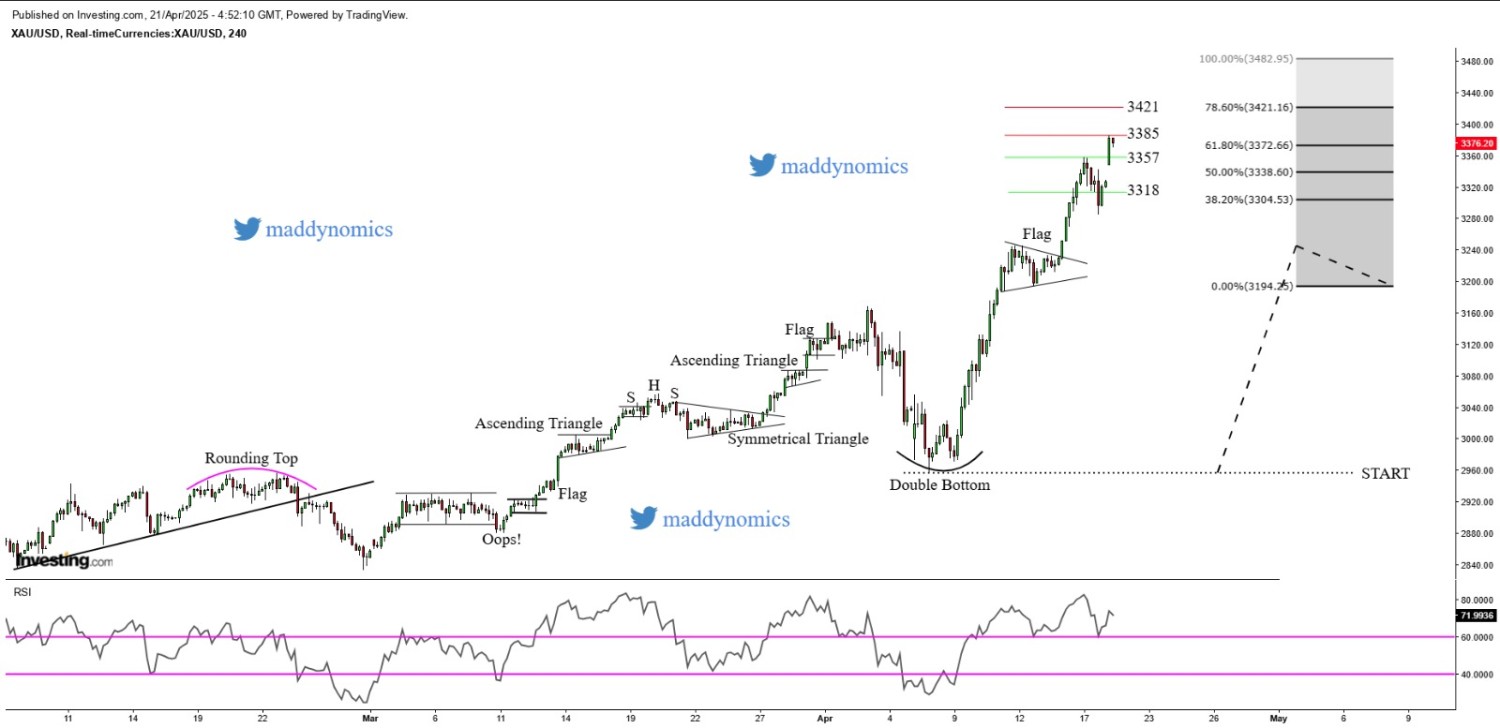

XAU/USD TECHNICAL OVERVIEW

Technical Structure: Gold is exhibiting a Double Top formation on the Daily chart, signaling potential exhaustion in the recent bullish momentum. Price is currently hovering around the 20-day Simple Moving Average. On the 4-Hour timeframe, a Bullish Engulfing pattern has emerged, suggesting short term buying interest however prices face rejection at the 20DSMA on 1-Hour chart, reinforcing selling pressure.

Intraday Trend/ Intraday Strategy: Intraday Bias remains in the favour of Bears and suggests the approach of Selling on Rise and Selling on Support Breakdown

Weekly Trend: Neutral

Major Support: 3316, 3305, 3290

Major Resistance: 3330, 3340, 3348

Recent News

DAX making H&S in 1HR time frame

November 27, 2024

Market Insights

WTI Crude Oil Faces Key Support Test Ami...

May 31, 2025

Market Insights

DOW JONES ANALYSIS

November 07, 2024

Market Insights

Gold soars to unprecedented highs driven...

April 21, 2025

Market Insights

Dow Jones Forms Bearish Flag Eyes Suppor...

March 04, 2025

Market Insights

Gold consolidates to build up momentum a...

April 30, 2025

Market Insights