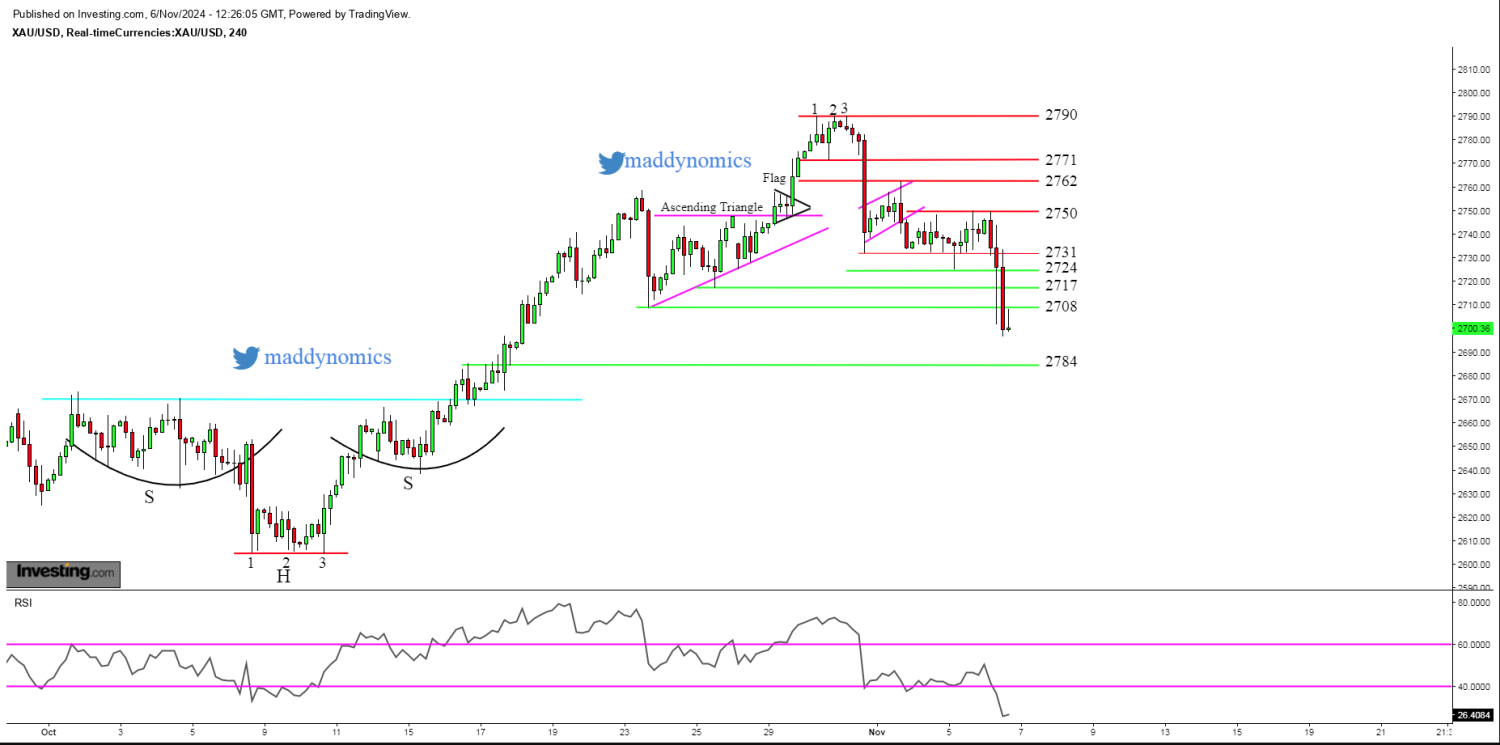

Gold trading in Symmetrical Triangle before much awaited CPI Data

Gold price (XAU/USD) gains some positive traction on Wednesday and for now, seems to have snapped a three-day losing streak to its lowest level since September 20, around the $2,590-$2,589 region touched the previous day. The Dollar Index is trading at June High's but it seems like buyers are losing momentum as EURUSD is also rebounding after a major correction. The October inflation forecast is showing 2.6 vs 2.4 September which is higher than expectations. If CPI is coming higher than 2.4 or even higher than 2.6 then it would be positive for US Dollar & Bond Yields. Alternatively if CPI is coming lower than 2.4 or lower than that then its positive for Gold.

Technically, Gold is forming a Symmetrical Triangle Pattern on 1hr Chart. Although the Larger Time frame like Daily is still negative but a breakout can push yellow metal prices slightly up. It is important to know that currently Gold is trading above 8SMA on 4hr & also sustaining above 1hr 20SMA from past 13 hours. If the data is coming positive for Gold then it can test the yesterday high at around $2617 where the 1hr 55SMA is also coming. The major resistance stands at $2627. Any sizeable upside should be coming after clearance of $2627 level.

On the contrary if the data is coming negative for Gold then below $2600 it will again become weak & the last day support at $2589 will act as a major support, but its imporatnt to note that below $2589 the next major support is coming around $2564 where the 89DSMA is coming up. Any further weakness below this level may push Gold prices towards the levels of $2535-2540.

Recent News

FOMC

November 07, 2024

Market Insights

GERMANY FY2025 revenue is expected to sl...

November 13, 2024

Market Insights

Gold rises toward $2,700, hits two-week...

November 22, 2024

Market Insights

AUDUSD DOWN RALLY START

October 22, 2024

Market Insights

Gold Weekly Trading Strategy

October 21, 2024

Market Insights

Gold losses its shine as Trump trade ful...

November 06, 2024

Market Insights