Gold swiftly bounces back from 55-SMA on the Daily chart : Sign of a trend reversal or a temporary recovery?

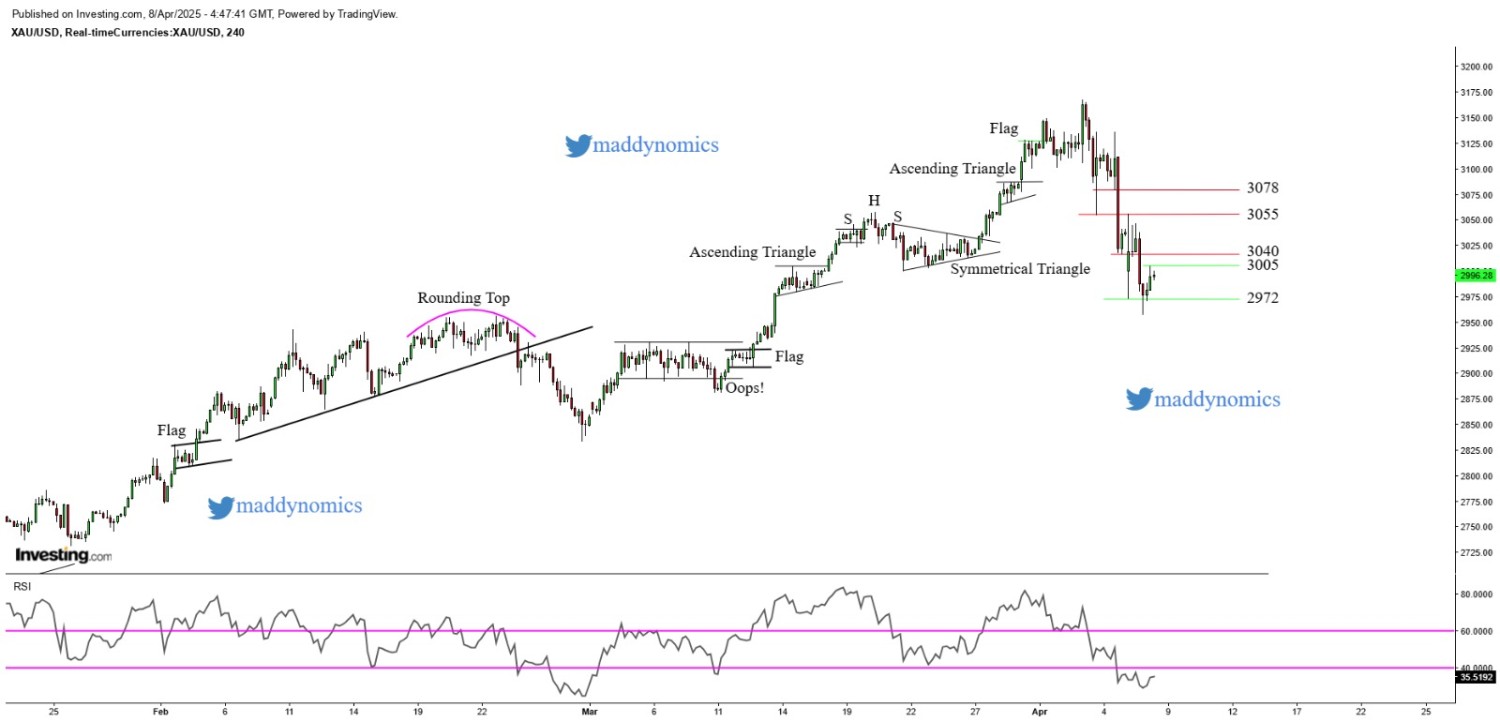

Bouncing back from the 55-Simple Moving Average on the Daily timeframe, Gold exhibits modest recovery after hitting the intraday low of $3120. The yellow metal travelled up by almost 60 points and recouped its early losses registered in the Thursday's Asian session. Adding to this, the dollar index failed to stabilize above the 101 mark and declined by 0.2% as the greenback lost its footing against its major peers, erasing gains from Monday when US-China announced a 90-days pause in their respective sweeping tariffs. The US 10 year treasury yields dropped from a monthly high to 4.51%, further acting as a tailwind for gold. The sharp recovery in gold prices and supportive fundamental factors raise odds of a trend reversal however from a technical perspective multiple resistance might cap the upside in the precious metal. Traders should wait for the release of Producer Price Index and the Fed chair Jerome Powell's appearance at a press conference today for fresh directional cues before placing any bet.

Recent News

Gold recaptures gains after a three day...

March 25, 2025

Market Insights

Gold climbs to $3000 but scope for gains...

April 08, 2025

Market Insights

Gold at a crossroad: RSI Divergence is s...

August 28, 2025

Market Insights

US Tech 100 Tests $20,000 Support Amid B...

March 07, 2025

Market Insights

After a parabolic move in Gold, Its time...

February 11, 2025

Market Insights

US Tech 100 Forms Bearish Flag – Breakdo...

July 11, 2025

Market Insights