Gold Sustaining near Life-High Levels.

Gold price (XAU/USD) reverses an intraday dip to the $2,924 area and climbs to the top end of its daily range, closer to the all-time peak heading into the European session on Wednesday. Investors remain worried that US President Donald Trump's tariff plans could trigger a global trade war, which continues to act as a tailwind for the safe-haven bullion. Moreover, expectations that the Federal Reserve (Fed) will cut interest rates further keep the US Dollar (USD) bulls on the defensive and offer additional support to the non-yielding precious metal.

Gold Structure: Strong Bullish Candle on Daily, Small Triple Top on 4hr, Bear Flag on 1hr.

Intraday Strategy/ Intraday Trend: Sell on Rise, Sell on Break of Supports/ Bullish, Above 2943 Strong Bullish.

Weekly Trend: Strong Bullish

Major Resistance: 2939, 2943, 3011

Major Support: 2926, 2916, 2907

Recent News

Dow Jones 1 Hour Chart Key Support and R...

March 05, 2025

Market Insights

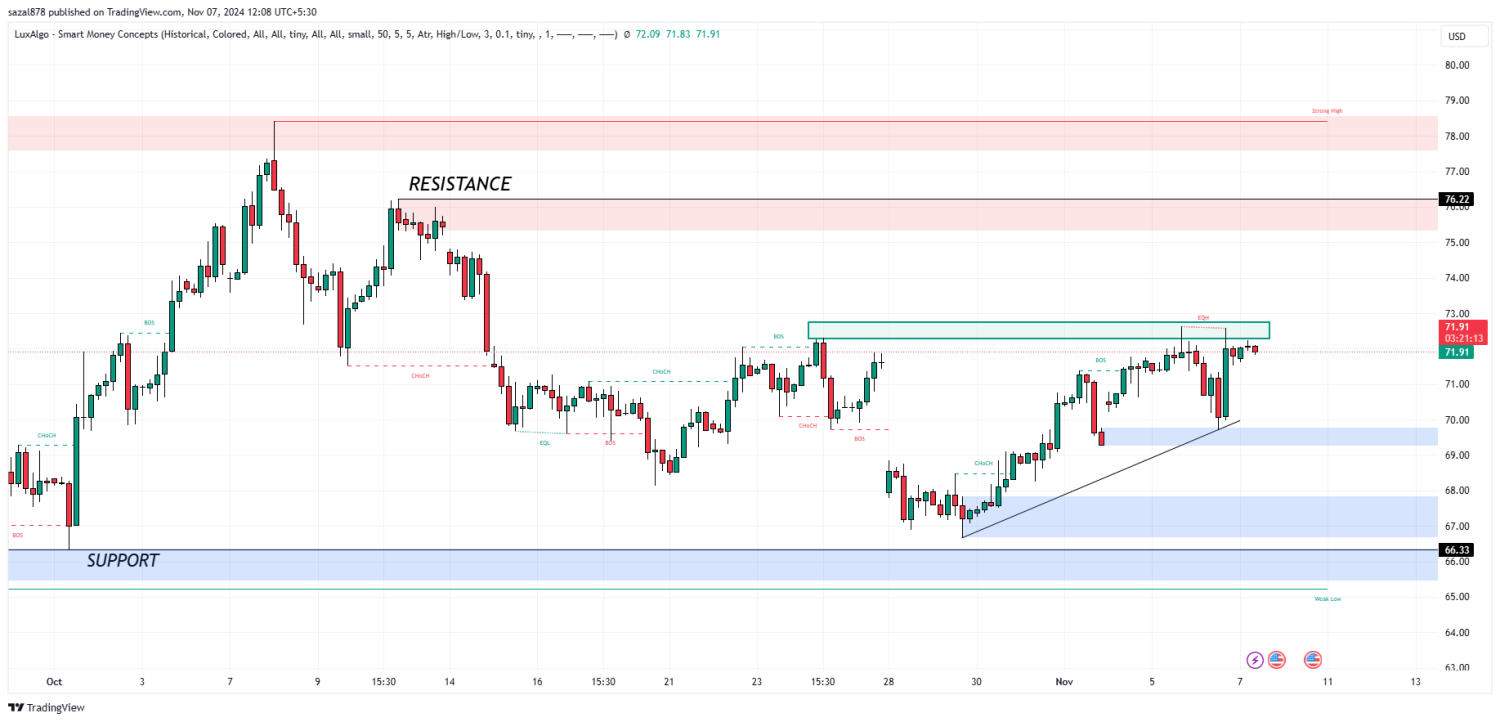

Oil Prices Surge Amid Trump Policy Specu...

November 07, 2024

Market Insights

Dow Jones Forms Bullish Flag Near 42,084...

March 20, 2025

Market Insights

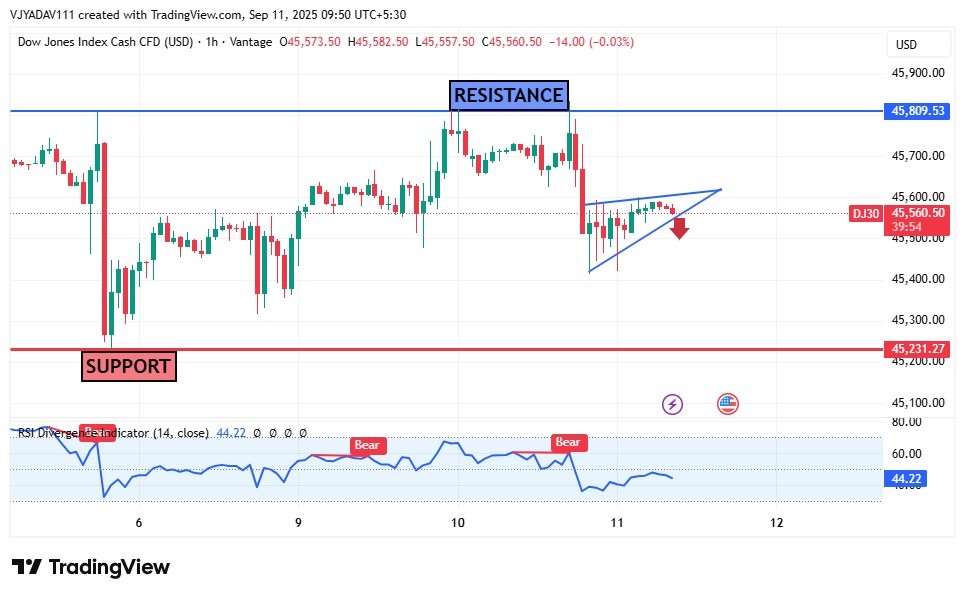

Dow Jones Faces Bearish Pressure Near 45...

September 11, 2025

Market Insights

GOLD'S HEAD AND SHOULDERS PATTERN EMERGE...

June 06, 2025

Market Insights

Gold may halt rally after 8 Days of Buyi...

October 22, 2024

Market Insights