Gold rises as USD drops to three-year low, traders now await US macro data

Gold trades higher for the second day on Thursday but remains capped below $3,350 in early European trade. Support for the metal comes as the US Dollar sinks to its lowest since March 2022, driven by market concerns over Fed independence following reports that President Trump may replace Fed Chair Powell.

However, upside in Gold remains limited as the Israel-Iran ceasefire holds, easing geopolitical risks and reducing safe-haven demand. This keeps traders cautious about confirming a near-term bottom for Gold, especially after its recent dip below $3,300.

Looking ahead, traders await key US macro data and FOMC speeches for fresh cues. The focus remains on Friday’s US PCE Price Index, which could provide clearer direction for Gold’s next move.

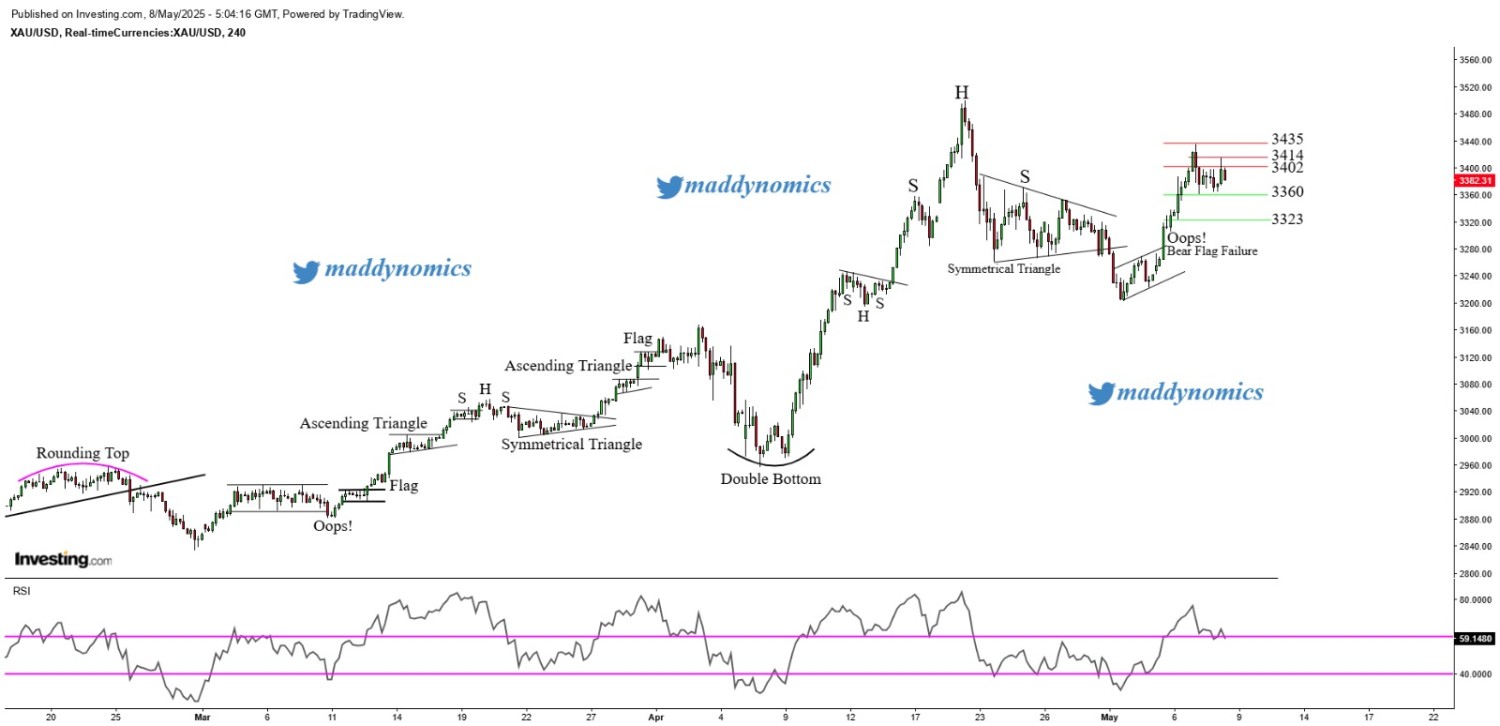

XAU/USD TECHNICAL OVERVIEW

Technical Structure: Gold price is showing signs of consolidation on the daily chart with an Inside Bar Spinning Top pattern, indicating market indecision. The metal is currently finding support at the 55-day Simple Moving Average (55DSMA), suggesting underlying buying interest at lower levels. On the 4-hour chart, Gold is forming a Higher Low (HL) structure, reinforcing short-term bullish sentiment. Additionally, the 1-hour chart shows a developing Bullish Flag pattern, often seen as a continuation signal after a prior uptrend.

Weekly Trend: Neutral

Intraday Trend/ Intraday Strategy: The outlook remains neutral, with a buy-on-supports and sell-on-resistance approach recommended. Momentum is expected to turn strong above 3343, while a break below 3310 may invite fresh weakness.

Major Support: 3329, 3321, 3312

Major Resistance: 3350, 3357, 3365

Recent News

Gold may halt rally after 8 Days of Buyi...

October 22, 2024

Market Insights

Gold Prices Hold Strong Amid Trade War F...

March 12, 2025

Market Insights

Gold Price Analysis Consolidates Above 2...

March 07, 2025

Market Insights

Gold Eyeing New Highs Amid Consolidation...

February 21, 2025

Market Insights

Gold remains under renewed pressure foll...

May 08, 2025

Market Insights

Gold Surges to Historic High of $3,057 A...

March 22, 2025

Market Insights