Gold remains under renewed pressure followed by Fed's hawkish stance

Gold edged higher above $3400 in the early Asian session on Thursday, recouping losses registered in the previous session. However, prices struggled to hold onto intraday gains, exhibiting a neutral movement across multiple timeframes. Bullion is supported by renewed safe-haven demand amid lingering geopolitical tensions—including the Russia-Ukraine conflict, Middle East unrest and rising India-Pakistan border risks. Adding to the bullish tone, US President Trump downplayed the urgency of a US-China trade deal. He denied to roll back the import duties of 145% levied on China to initiate trade war negotiations, dampening global risk appetite. This remark unfolds just few days ahead of US Treasury Secretary Scott Bessent's scheduled meeting with his Chinese counterpart in Switzerland on Sunday.

Meanwhile, the US Dollar is under fresh pressure following the FOMC policy meeting held on Wednesday. In his post-meeting remarks, Fed Chair Jerome Powell acknowledged significant uncertainty surrounding tariffs and said the Fed will wait for more clarity before making any policy moves. This cautious stance suggested rate cuts are off the table for now, but the message failed to strengthen the US Dollar, further boosting Gold. However, a mildly positive risk tone is limiting aggressive upside. Still, the overall backdrop favors further gains in XAU/USD.

Market focus now shifts to US Initial Jobless Claims data and any details from Trump's anticipated trade deal announcement for near-term direction.

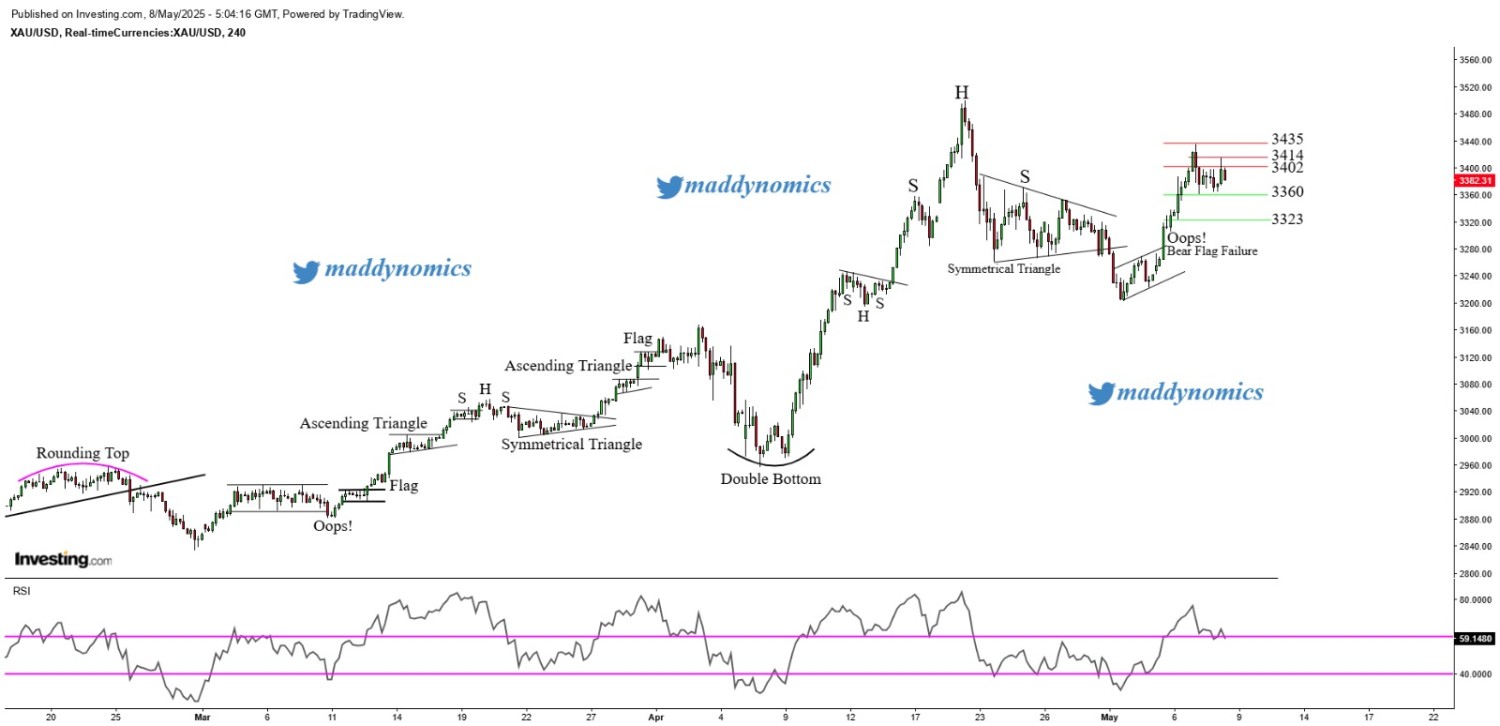

XAU/USD TECHNICAL OVERVIEW

Technical Structure: The daily chart of Gold showcases the formation of a Bearish Marubozu , indicating strong selling pressure. On the 4-Hour chart, a Dark Cloud Cover candlestick pattern has resurfaced, signifying a potential drop in the prices. The pattern is coupled up with a Vertical Fall on the 15-Minute Chart of Gold hinting at further bearish momentum.

Intraday Trend/ Intraday Strategy: The intraday bias remains Neutral and favours the approach of Buying on Supports and Selling on Resistance.

Weekly Trend: Bullish

Major Resistance: 3360, 3394, 3404

Major Support: 3330, 3310, 3280

Recent News

NAS100 Breaks Support After Bearish Chan...

August 20, 2025

Market Insights

US Tech 100 Surges with Bullish Flag Nea...

April 25, 2025

Market Insights

Gold Holds Breath Ahead of US CPI Inflat...

February 12, 2025

Market Insights

Gold price posts modest gain amid trade...

February 26, 2025

Market Insights

Gold achieves a new record high of $3128...

March 31, 2025

Market Insights

The Japanese Yen has the upper hand agai...

March 11, 2025

Market Insights