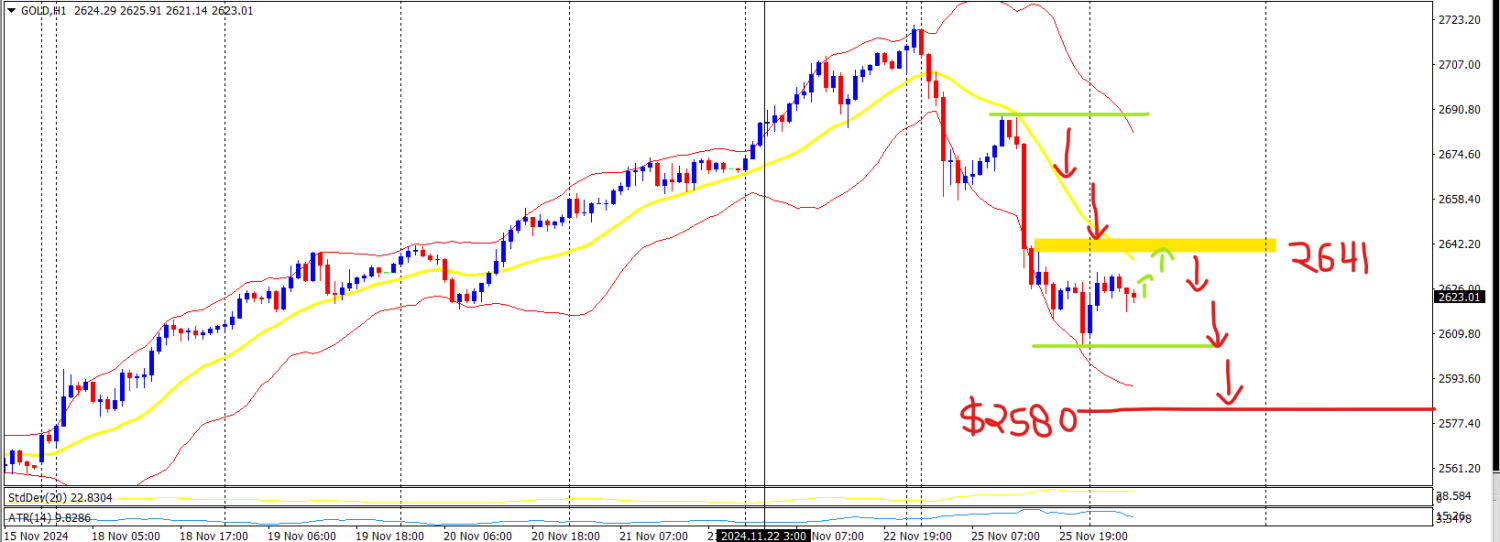

Gold Prices Face Bearish Reversal as Head and Shoulders Pattern Forms Amid Weak U.S. Economic Data

Gold prices are at a critical juncture as a Head and Shoulders pattern emerges on the XAU/USD 1-hour chart. Despite support from central bank buying, rate cut expectations, and ETF inflows, the technical pattern signals a potential downside. Investors await Friday’s Nonfarm Payroll (NFP) report for further clarity on the Federal Reserve’s stance.

Technical Analysis: Key Levels to Watch

Gold recently formed a Head and Shoulders pattern, a bearish reversal signal:

Neckline (S1 at ~$3,100): A key support level; a break below confirms downside potential.

Support Levels: If the pattern plays out, gold may test $3,065, with a further decline to $3,004.

Resistance: A rebound above $3,115 could push prices to $3,140-$3,160.

Market Sentiment and Fundamentals

Bullish Factors: Rate cut expectations, Chinese ETF adding 233,000 ounces, and strong ETF demand.

Bearish Risks: Weak U.S. economic data and a potential strong NFP report boosting the dollar.

Outlook and Strategy

Gold remains in a critical decision zone:

Bearish case: A break below $3,100 could trigger a decline to $3,065 and $3,004.

Bullish case: Holding above $3,115 could lead to further gains.

NFP Report on Friday remains the key catalyst for the next major move

Recent News

DOW JONES

November 08, 2024

Live Charts

Gold price stalls intraday recovery from...

November 26, 2024

Market Insights

DAX sharp fall after FOMC

December 19, 2024

Market Insights

US Tech 100 Consolidates Near Highs Bull...

July 18, 2025

Market Insights

Nasdaq lost 0.5%, marking a third consec...

September 26, 2025

Market Insights

Gold tests the Top – Breakout from Desce...

July 11, 2025

Market Insights