Gold holds at Ascending Triangle Support after false breakdown near $3,340

Gold dropped to a fresh three-week low of $3,311.58/oz during Asian hours after earlier rebounding to $3,340. Selling pressure stemmed from a stronger USD, though softer US yields provided some cushion. Technically, the metal staged a false breakdown of ascending triangle support but is now trading back at that level, keeping short-term sentiment mixed.

Markets now shift focus to the FOMC minutes and the Jackson Hole Symposium, with investors seeking clarity on future rate cuts and the dissenting votes from Fed officials Bowman and Waller. Upcoming flash PMI data will also be key in shaping expectations for US economic momentum and Fed policy outlook.

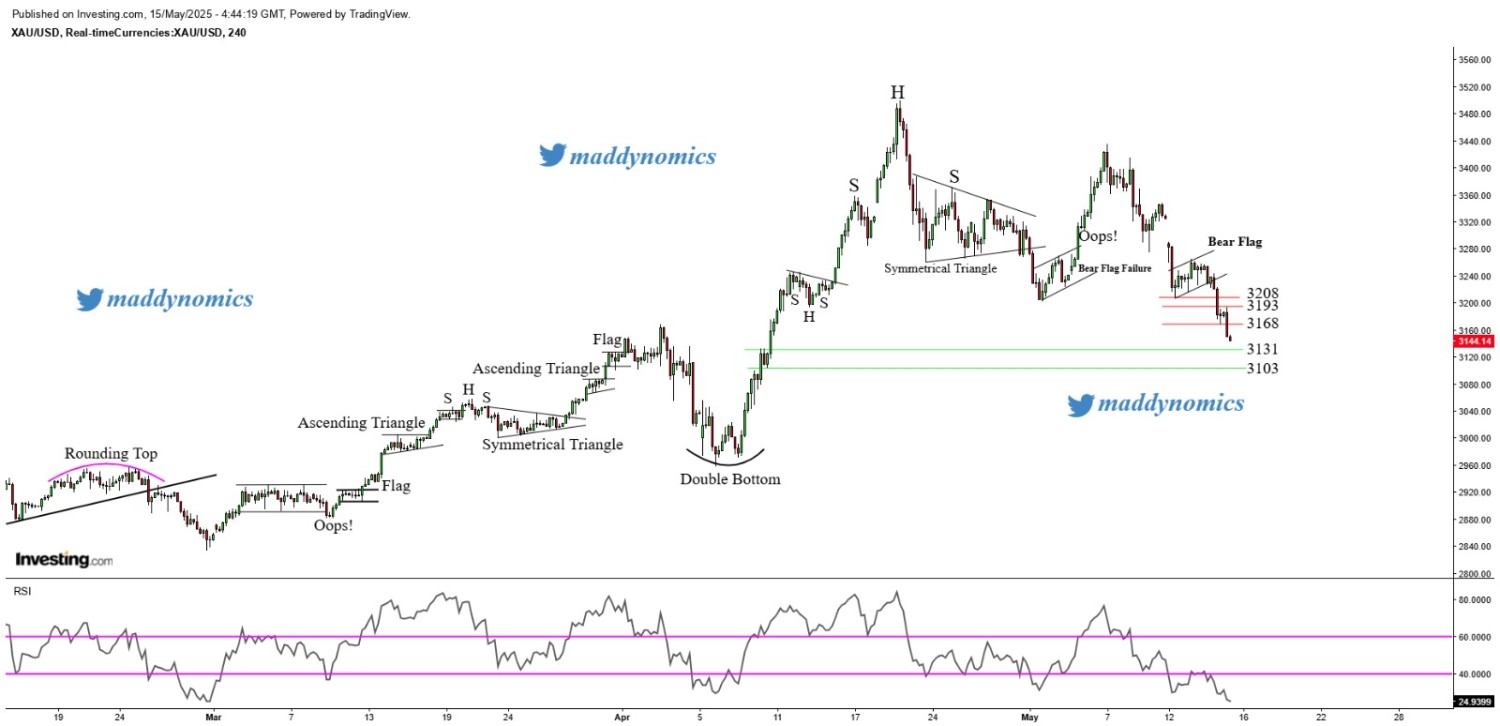

XAU/USD TECHNICAL OVERVIEW

Technical Structure: Gold is showing a constructive technical structure, supported by multiple bullish signals. On the daily chart, a Bullish Engulfing pattern has formed, with prices holding above the 20-SMA, reinforcing upward momentum. The 4H chart confirms a channel breakout, while the 1H chart reflects ongoing consolidation, suggesting a buildup before the next directional move.

Weekly Trend: Neutral

Intraday Trend/ Intraday Strategy: The intraday outlook leans bullish, favoring a buy-on-dips and buy-on-breakout strategy

Major Support: 3330, 3314, and 3300

Major Resistance: 3347, 3360, and 3375

Recent News

DOW JONES making bullish Flag in 1HR

February 14, 2025

Market Insights

NASDAQ extends rally after breakout abov...

October 30, 2025

Market Insights

Gold plunges to a one-month low, clings...

May 15, 2025

Market Insights

Natural Gas Breaks Out of Bullish Flag R...

March 04, 2025

Market Insights

US Tech 100 Bullish Flag at Resistance S...

May 01, 2025

Market Insights

Gold struggles near daily low after posi...

July 07, 2025

Market Insights