Gold edges higher on Friday to $3375 ahead of Non-Farm Payroll Data

Gold holds modest gains in early European trading on Friday but remains below the $3,400 level, retreating slightly from the multi-week high hit on Thursday. The upside appears limited as the US Dollar recovers from its recent lows, supported by repositioning ahead of the crucial US Nonfarm Payrolls (NFP) report.

Sentiment around gold is also weighed down by improved risk appetite and optimism over renewed US-China trade talks. However, investor caution lingers due to President Trump’s unpredictable trade policies, ongoing geopolitical tensions in Ukraine and the Middle East, and growing concerns over the US fiscal outlook. Expectations of Fed rate cuts in 2025 may restrain further USD strength, offering some underlying support to gold as markets await key labor market data.

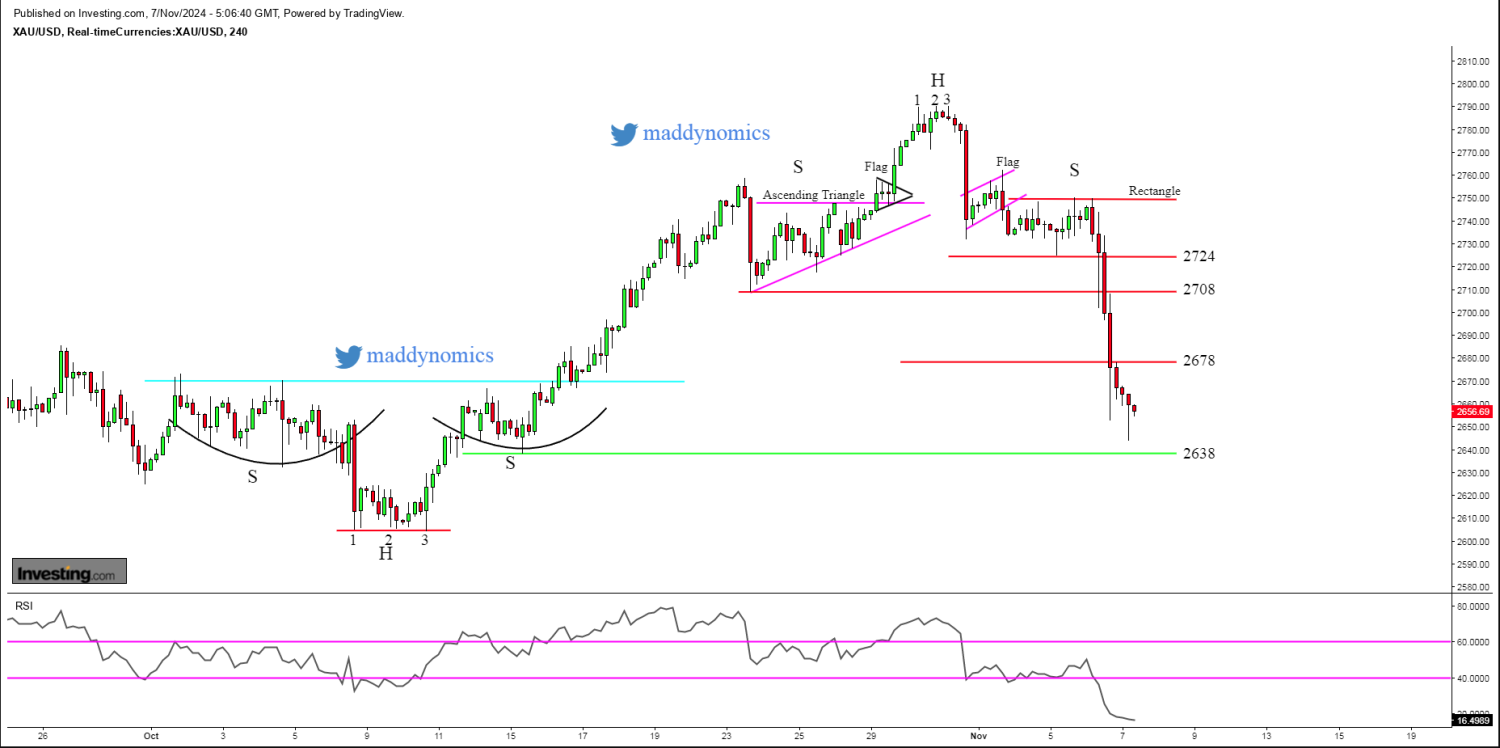

XAU/USD TECHNICAL OVERVIEW

Technical Structure: Gold is exhibiting mixed technical signals across multiple timeframes. On the daily chart, a Spinning Top candlestick highlights indecision among traders, though the broader structure suggests a Bullish Flag pattern, indicating potential for further upside. On the 4-hour chart, Gold recently witnessed a failed breakout, showing signs of resistance at higher levels.

Intraday Trend/ Intraday Strategy: The intraday bias remains bullish but will convert into bullish above $3384 and favours the strategy of buying on supports and selling on resistance.

Weekly Trend: Bullish

Major Support: 3350, 3339, 3300

Major Resistance: 3378, 3388, 3403

Recent News

Gold Holds Near $2,685 Amid Fed Rate Cut...

November 08, 2024

Market Insights

Dow Jones at Critical Support Bearish Pr...

May 22, 2025

Market Insights

AUD/USD awaits a breakdown for the next...

November 12, 2024

Market Insights

NASDAQ made a bullish flag will bull con...

June 16, 2025

Market Insights

Gold & Silver trading sideways as Trader...

November 07, 2024

Market Insights

US Tech 100 Approaching Key Resistance L...

May 26, 2025

Market Insights