Gold Drops After $2,900–$3,000 Rejection as US Dollar Strengthens on Inflation Fears

Gold (XAU/USD) retreats after hitting strong resistance at $2,900–$3,000, pressured by a stronger US Dollar amid inflation concerns. While US GDP remains steady at 2.3%, rising Core PCE inflation (2.7%) fuels expectations of a cautious Fed stance, boosting the greenback.

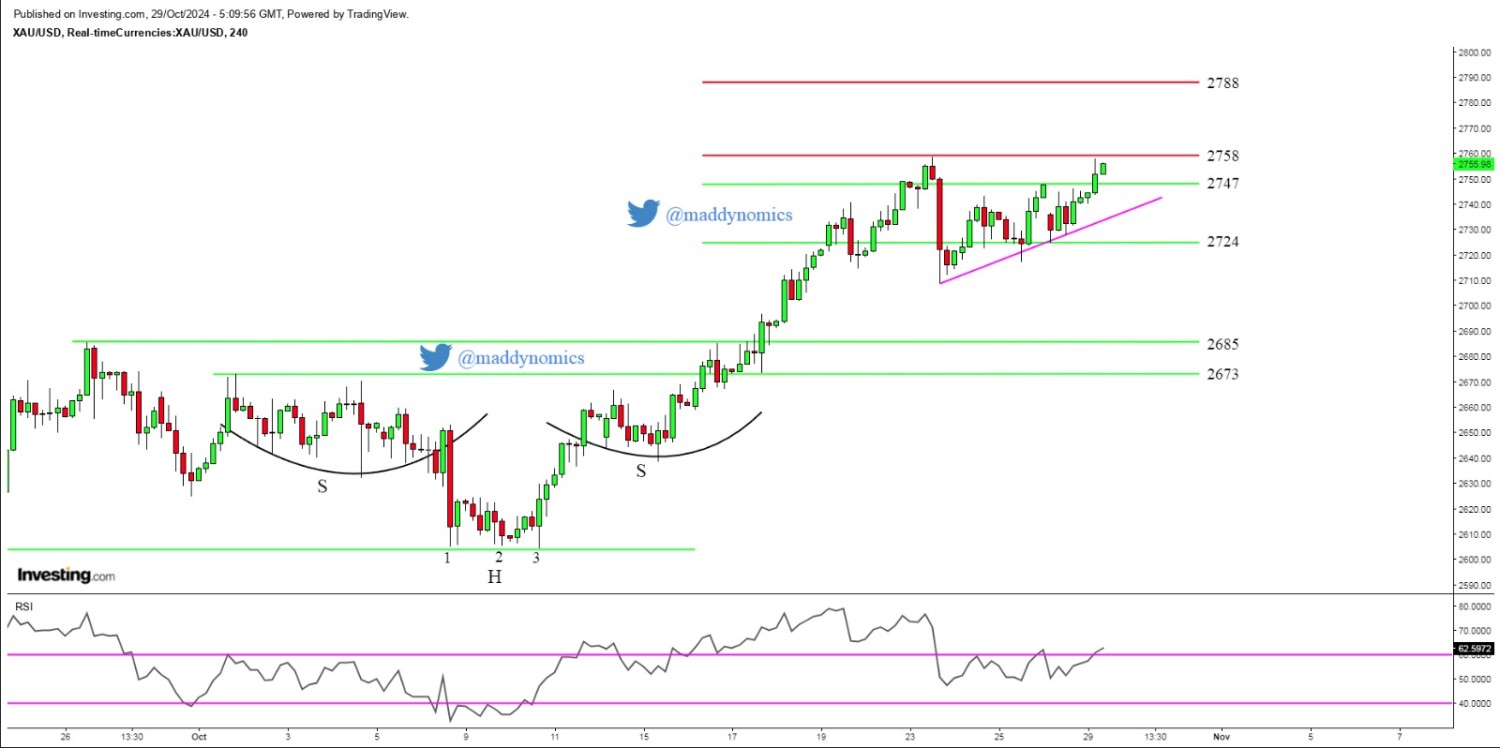

Technically, gold is correcting lower, with key support at $2,865. A break below could extend losses to $2,800, while holding above may trigger a rebound toward $2,950–$3,000. The RSI is cooling off from overbought levels, suggesting further downside, but the ascending broadening wedge and ascending channel signal a potential buying opportunity.

Recent News

Gold trading near ATH, Bulls are waiting...

October 29, 2024

Market Insights

Gold recovers from weekly low amid safe-...

June 19, 2025

Market Insights

Nasdaq 100 Holds Above 23,600 — Bullish...

August 29, 2025

Market Insights

Gold prices struggle to sustain above $2...

March 11, 2025

Market Insights

Crude Oil Surges from Major Support Leve...

April 19, 2025

Market Insights

Dow Jones Holds Above Trendline Support,...

September 22, 2025

Market Insights