EUR/USD stays pressured toward 1.0800 amid fresh US Dollar demand

Immediate resistance lies at the YTD high of 1.0954 (March 18). A firm break above that level would target 1.0969 (the 23.6% Fibonacci retracement) and could pave the way for a test of the psychological 1.1000 barrier.

On the downside, the 200-day Simple Moving Average (SMA) at 1.0728 acts as initial support, followed by the provisional 100-day SMA at 1.0522 and the 55-day SMA at 1.0498. Below these levels are 1.0359 (the February 28 low), 1.0282 (the February 10 low), 1.0209 (the February 3 low), and the 2025 bottom of1.0176 (January 13).

Momentum signals remain somewhat bullish, with the Relative Strength Index (RSI) sitting around 62, and the Average Directional Index (ADX) near 32 indicating a strengthening uptrend.

Recent News

Dow Jones Forms Bullish Flag Near 44,650...

July 25, 2025

Market Insights

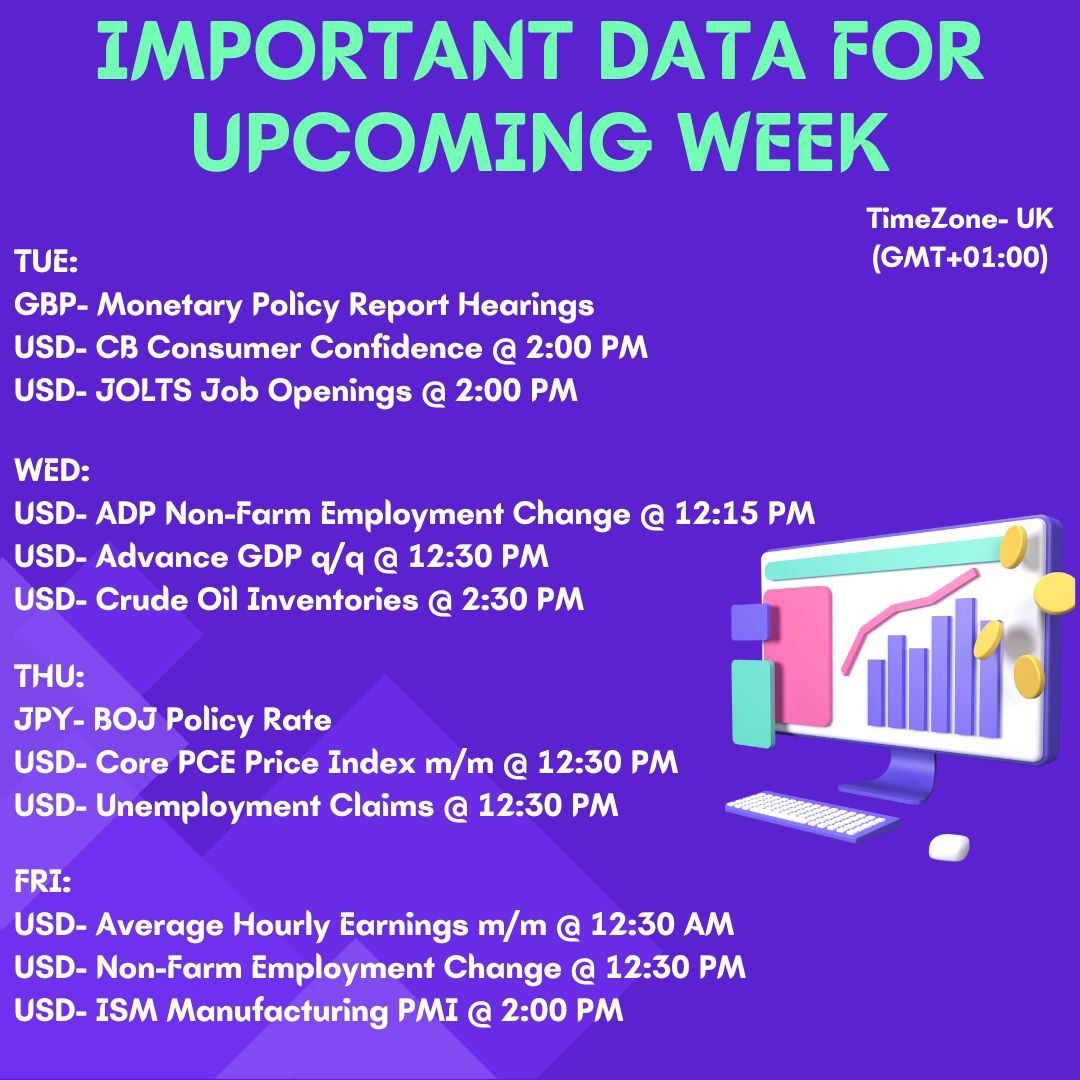

IMPORTANT DATA's FOR THIS WEEK

October 28, 2024

Market Insights

Gold Forms Bullish Flag Above $4,000 — E...

October 25, 2025

Market Insights

Natural Gas 4 Hour Chart Pinpointing the...

March 03, 2025

Market Insights

Dow Jones Shows Bullish Flag Pattern Ami...

April 08, 2025

Market Insights

Nasdaq 100 Consolidates Below Resistance...

September 30, 2025

Market Insights