GOLD Analysis & Market Overview: Key Levels and Fed Expectations

On the downside, if the price fails to hold 2,620, the next key support lies around 2,535, which should be closely monitored for potential further downside pressure.

Overall, short-term bullish bias as long as 2,620 holds, but a break below this level would shift the momentum to neutral-to-bearish.

Market Overview: Fed Expectations and Geopolitical Tensions

There are growing expectations that the U.S. Federal Reserve will skip a hoped-for interest rate cut in December. Higher interest rates typically dampen the appeal of non-interest bearing assets like gold, potentially limiting upside in the metal. On the geopolitical front, tensions remain mixed. While the situation in Ukraine escalates, a ceasefire agreement between Israel and Lebanon could provide some relief to market sentiment. These mixed factors contribute to an uncertain environment for precious metals and may weigh on gold's price movement in the short term.

Recent News

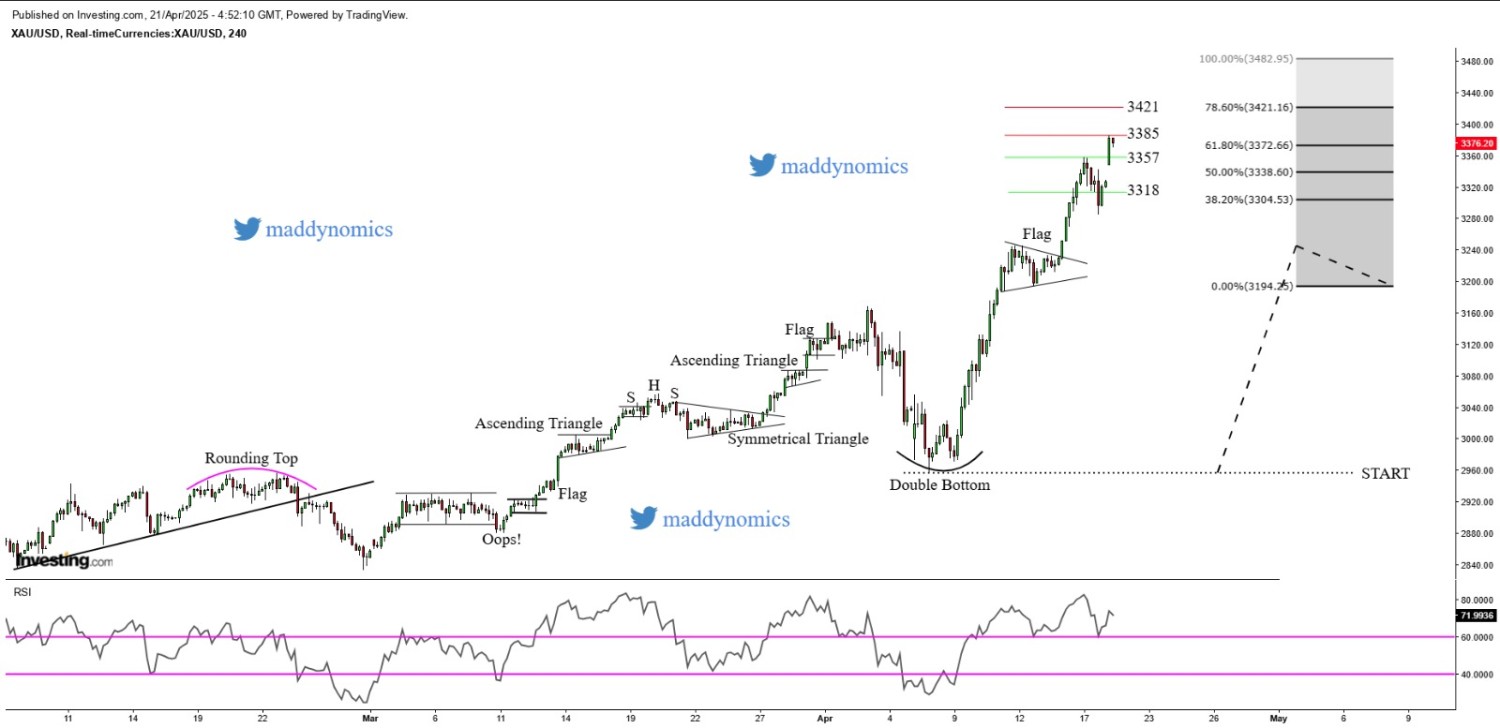

Gold soars to unprecedented highs driven...

April 21, 2025

Market Insights

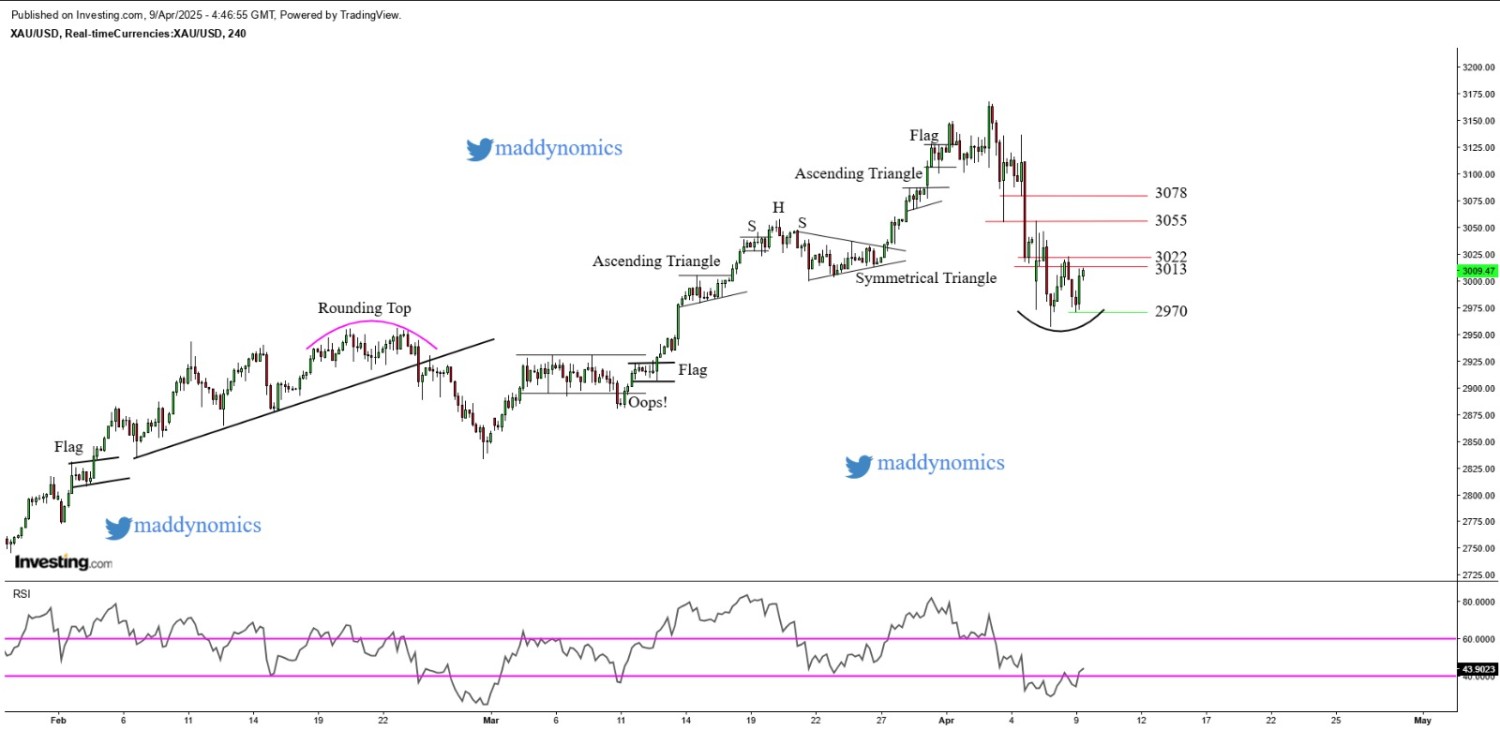

Gold regains momentum on rising safe-hav...

April 09, 2025

Market Insights

NASDAQ100 Holds Support at 21,562 Eyeing...

June 19, 2025

Market Insights

Gold edges higher amid tariff tensions a...

July 21, 2025

Market Insights

Dow Jones Faces Bearish Pressure Near 44...

August 12, 2025

Market Insights

DOW JONES making a pennant pattern on re...

May 12, 2025

Market Insights